The euro-dollar pair has hit a wall at a critical resistance level, sparking renewed bearish sentiment among traders. After failing to break through the 1.1850–1.1900 zone, EURUSD is now looking vulnerable to further downside pressure.

A bearish outlook takes shape

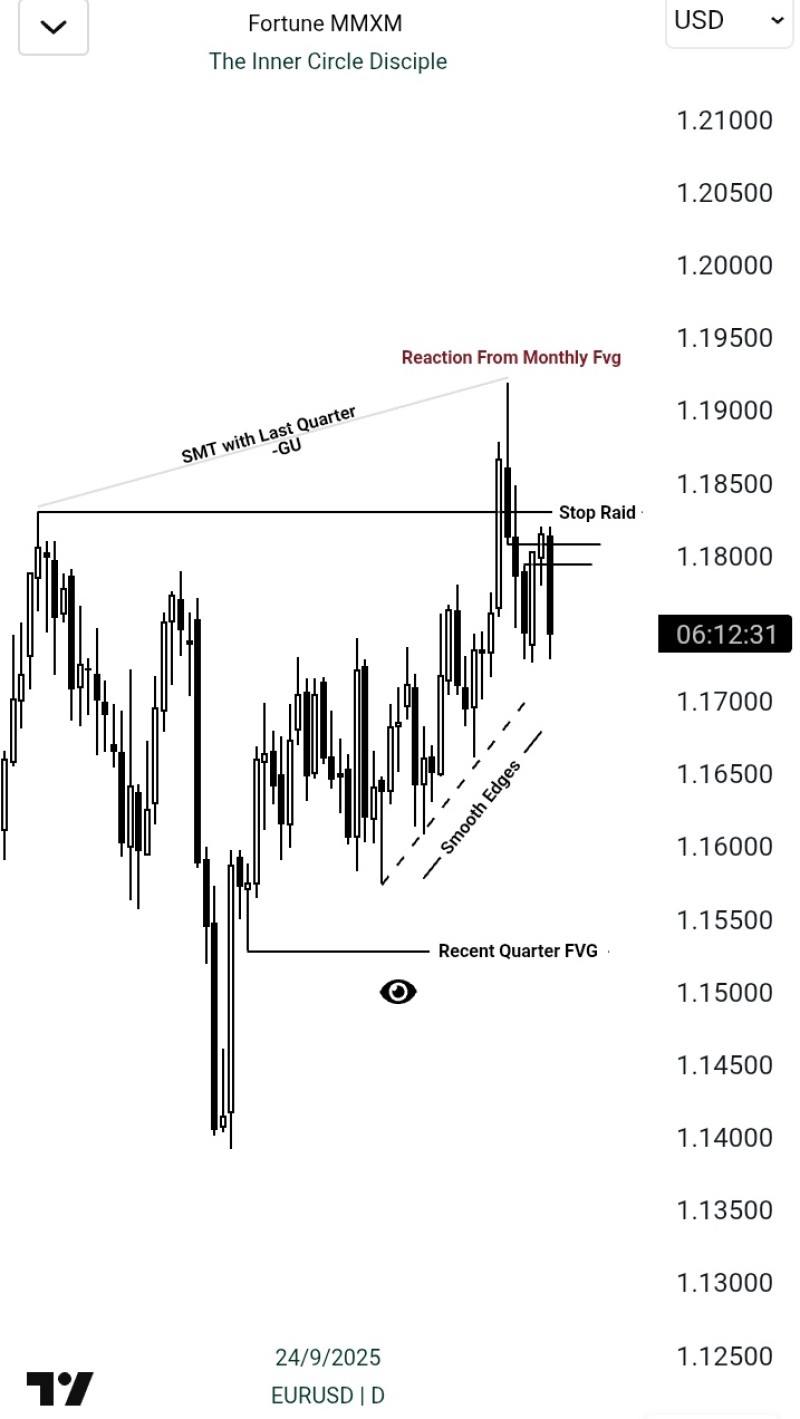

The euro-dollar pair is showing clear signs of weakness following a sharp rejection from the 1.1850–1.1900 resistance zone. This move supports the long-term bearish view from trader FortuneMMXM, who maintains that EUR/USD will stay under pressure "until proven otherwise by the market."

The chart reveals a reaction from a monthly fair value gap near 1.1900, followed by a failed stop raid that couldn't hold gains. This pattern confirms sellers are firmly in control of the pair's direction.

Technical breakdown reveals key levels

The rejection from 1.1850–1.1900 has effectively capped any bullish momentum, and traders would need to see a decisive break above 1.1950 to shift sentiment back to positive. On the downside, the next major support levels sit at 1.1650 and 1.1550, which line up with the recent quarter fair value gap shown on the chart. If bearish pressure continues to build, we could see an even deeper slide toward 1.1350.

The market structure is painting a concerning picture with a "smooth edges" pattern where lower highs keep forming. Adding to the bearish case is an SMT divergence with GBP/USD, which signals the euro is weakening relative to sterling and suggests broader euro vulnerability.

Macro factors driving the decline

Several fundamental drivers are working against the euro right now. The Eurozone continues to face economic headwinds with weak growth numbers and softer PMI data weighing on the currency. Meanwhile, the U.S. dollar stays supported by resilient economic data and a cautious Federal Reserve approach. Global uncertainty is also playing a role, as investors continue seeking the safety of the greenback during turbulent times.

EUR/USD remains under pressure after that decisive rejection of the 1.1850–1.1900 ceiling. Unless bulls can mount a convincing reclaim of this level, the path forward looks to be heading lower, with 1.1650 and 1.1550 standing as the next logical downside targets for traders to watch.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah