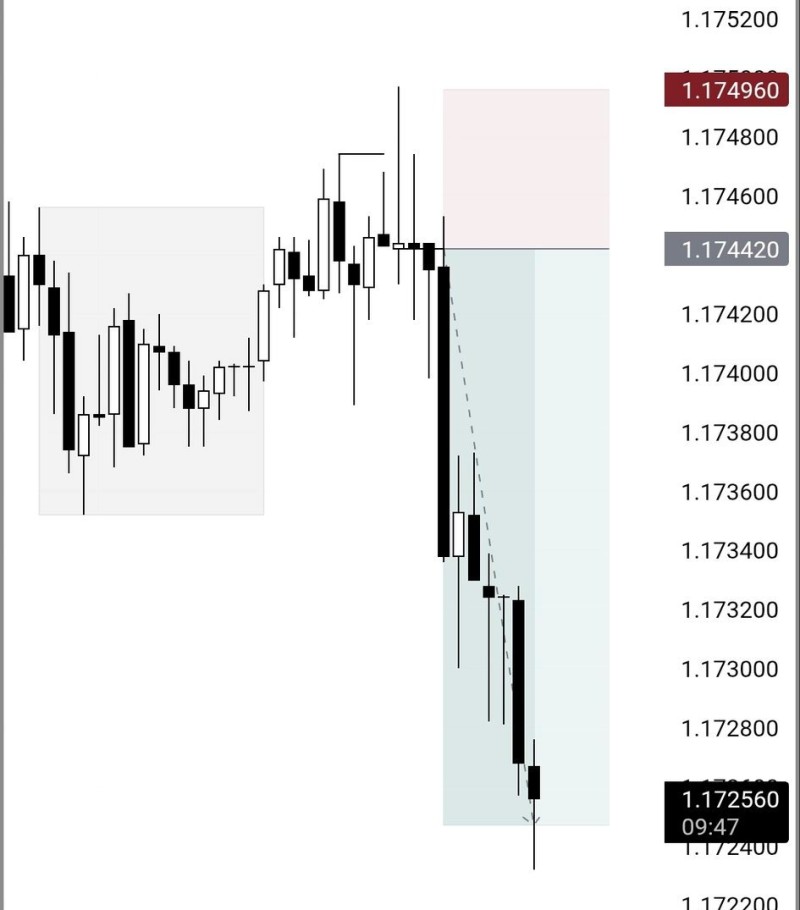

⬤ EUR/USD made a sharp move lower during the London session after briefly pushing higher and then reversing hard. The move followed a classic London open liquidity sweep pattern—early volatility clears buy-side liquidity before the market picks its real direction. The setup also showed SMT divergence against the U.S. Dollar Index, adding more bearish weight to the pair.

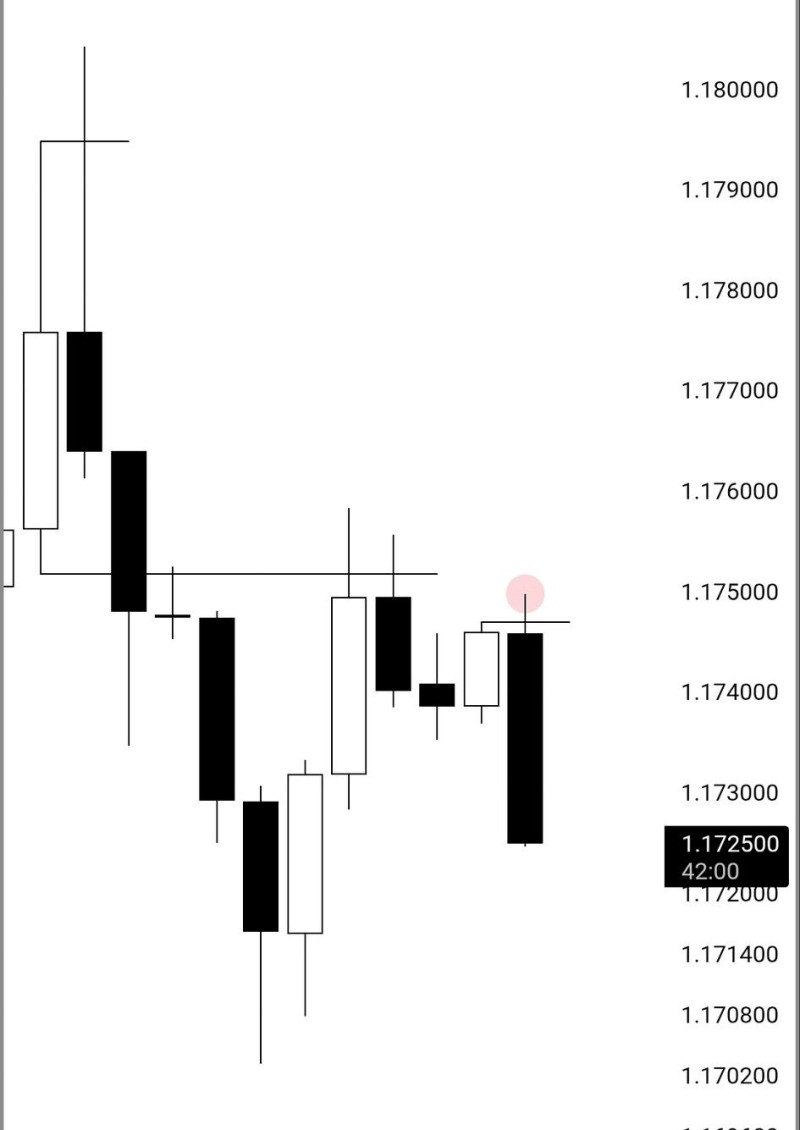

⬤ On the 4-hour chart, EUR/USD was already moving through a corrective phase, failing to break back above a key resistance zone. Price got rejected near an earlier high that formed at an important time, then immediately followed through to the downside. This shows that bulls couldn't hold momentum and confirms the market shifted back toward bearish control instead of continuing higher.

⬤ The 15-minute chart showed the move play out with precision. Price swept liquidity above a short-term range, then reacted sharply from a clear order block. The strong bearish candle that followed broke below local structure and confirmed short-term direction. It's the type of setup traders watch for during London opens when institutional flows enter the market.

⬤ This matters because EUR/USD keeps responding cleanly to session liquidity patterns and dollar strength. The SMT divergence with DXY points to underlying dollar support, while the rejection from higher timeframe levels adds technical confirmation. As long as price stays below that rejected order block zone, the short-term bias favors more downside, keeping focus on structure and liquidity rather than news-driven moves.

Peter Smith

Peter Smith

Peter Smith

Peter Smith