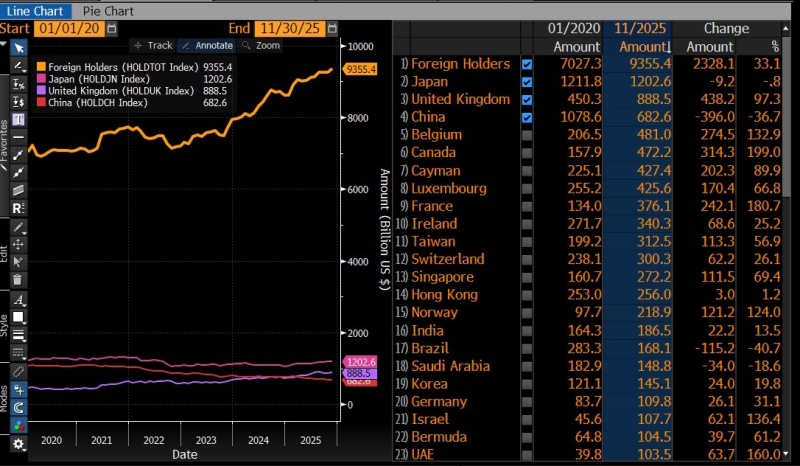

⬤ Foreign holdings of US Treasuries have been climbing steadily, and it's all about how central banks react when the dollar softens. When the USD weakens, other currencies naturally strengthen, which can hurt exports and economic growth. To counter this, monetary authorities step in and buy Treasuries, effectively managing their own exchange rates. The numbers tell the story clearly—total foreign Treasury holdings jumped from around $7.0 trillion in 2020 to over $9.3 trillion by late 2025.

⬤ Different countries took different approaches during this period. The UK, Belgium, Canada, France, and several offshore financial centers ramped up their holdings significantly. Meanwhile, major players like China and Japan either reduced their positions or kept them relatively flat. Still, the overall trend shows one thing: US Treasuries remain the go-to tool for reserve management and currency control.

⬤ Gold plays a completely different role here. Sure, central banks like adding gold to diversify their reserves and strengthen their balance sheets, but gold doesn't help manage currency valuations against the dollar or trading partners. When the main goal is controlling exchange rates rather than just diversifying assets, Treasury purchases are what actually get the job done. That's why Treasury demand stays strong even as alternative reserve assets get more attention.

⬤ This pattern matters because it shows just how central US Treasuries are to global finance. Foreign demand tied to currency management keeps the dollar at the heart of the international system, even when it's relatively weak. As long as governments want to support domestic growth through spending without letting their currencies get too strong, Treasuries will remain essential for shaping global capital flows and maintaining long-term monetary stability.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah