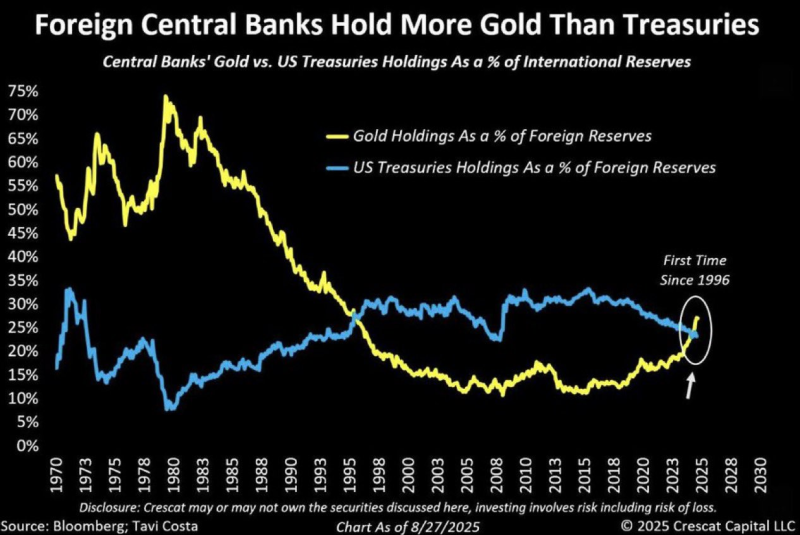

⬤ Foreign central banks have fundamentally reshuffled their reserve holdings, with gold now claiming a bigger slice than US Treasuries for the first time since 1996. A chart compiled from Bloomberg data reveals gold's share of foreign reserves climbing steadily in recent years while Treasury allocations have trended downward. The two lines crossed in 2025, capturing a pivotal moment in the decades-long evolution of reserve diversification.

⬤ The historical data paints a dramatic picture. Back in the 1970s and early 1980s, gold dominated reserve holdings at over 60% of the global total. That share then collapsed steadily for decades, bottoming out near 10% by the mid-2000s. US Treasuries moved in the opposite direction, jumping from roughly 10-15% in the mid-1970s to more than 30% at various points between 2008 and 2018. The August 27, 2025 data point marks the moment gold finally overtook Treasuries again—the first time in nearly three decades.

⬤ While gold's share has crept up gradually, the real story is the drop in Treasury allocations since around 2021. This isn't just a temporary market fluctuation—it reflects a structural shift in how central banks are managing their asset portfolios. The chart comes with standard disclaimers about investment risk and potential securities holdings by the data provider.

⬤ This shift carries real weight because gold and sovereign bonds are fundamental tools central banks use to manage currency stability, liquidity, and portfolio risk. When gold starts outweighing US Treasuries in global reserves, it signals changing priorities in reserve management, potential shifts in long-term confidence, and a recalibration of the balance between precious metals and government debt in the international financial system.

Peter Smith

Peter Smith

Peter Smith

Peter Smith