XRP is maintaining a historically significant formation against Bitcoin that could soon determine its next major move.

The Decade-Long Setup

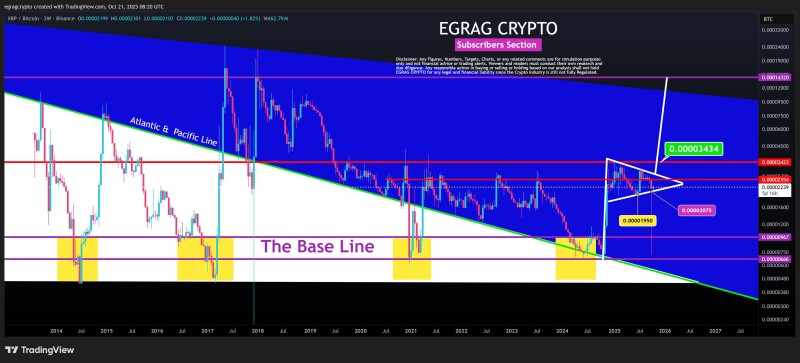

Crypto analyst EGRAG CRYPTO has identified what he calls the "Atlantic & Pacific Line"—a diagonal resistance that's been defining XRP/BTC price action for years. Despite recent choppiness, the pair is holding its structure, and momentum appears to be building toward a potential breakout.

The XRP/BTC chart reveals a multi-year descending wedge trapped between two critical lines: the "Atlantic & Pacific Line" (upper resistance) and the "Base Line" (major support). Every time the pair has hit that Base Line—in 2014, 2017, 2020, and early 2024—it's sparked a macro rally.

Right now, XRP sits at 0.000022 BTC, comfortably above key support levels at 0.00002075 and 0.00001950. According to Egrag, unless XRP/BTC closes below these thresholds on a weekly timeframe, the bullish structure stays intact. Everything else? Just noise.

Support zones:

- Primary Base Line: 0.00000967 BTC (historical accumulation zone)

- Local support: 0.00001950–0.00002075 BTC (current structural floor)

Resistance targets:

- Immediate: 0.00002554 BTC

- Key breakout: 0.00003434 BTC

- Extended target: 0.00004320 BTC

The chart also shows a tightening symmetrical triangle forming since early 2024. Volume is drying up, volatility is shrinking—classic signs that something big might be brewing. Historically, these setups have led to 2–3x moves once resistance finally cracks.

Why This Matters Now

Throughout 2024, Bitcoin's dominance has kept altcoin pairs like XRP/BTC under pressure. But history suggests this could be temporary. XRP typically gains strength late in Bitcoin dominance cycles, especially when liquidity starts rotating back into large-cap alts. As long as the long-term structure holds, every dip into support looks more like an accumulation opportunity than a breakdown.

The "Atlantic & Pacific Line" has acted as a ceiling for years. Breaking it would mark the first clear bullish reversal since 2018. On the flip side, a weekly close below 0.00001950 BTC would invalidate the wedge, though even past breakdowns have historically led to renewed accumulation rather than collapse.

XRP/BTC is approaching the triangle's apex, which usually means a volatility spike is coming. If bulls hold the 0.00002075–0.00001950 zone, the odds favor a breakout attempt toward 0.00003434. The pattern has been building for nearly a decade, and every previous base retest has been followed by a sharp move higher. The structure is still intact—now it's a waiting game.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah