While most traders chase short-term price swings, something more interesting is happening beneath the surface with XRP. The token seems to be following the Wyckoff accumulation model—a time-tested framework that shows how big players quietly build positions before prices take off.

XRP and the Wyckoff Pattern

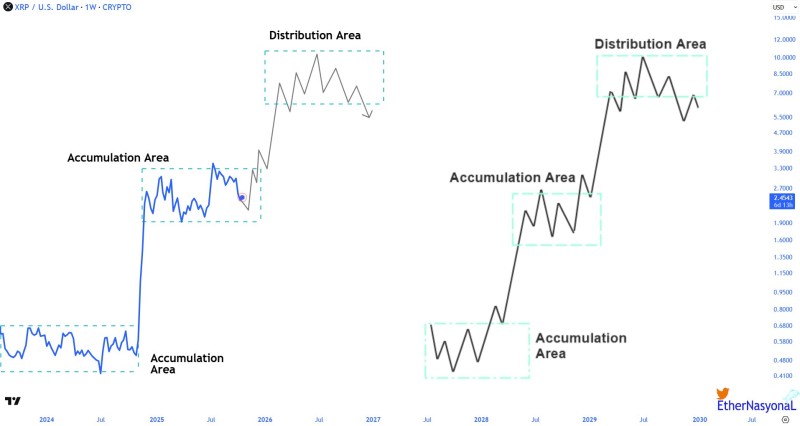

Analyst EtherNasyonaL points out that XRP's current chart looks remarkably similar to early 2017, right before its explosive rally. The difference? Today's market is more mature, liquid, and regulated, which could make this setup even more reliable.

The Wyckoff Method breaks market cycles into distinct phases where institutional money accumulates assets before pushing prices higher. Looking at XRP's weekly chart, you can see this playing out in real time. There's a clear pattern: accumulation zones where price moves sideways, followed by sharp vertical breakouts, and then distribution zones where profits get taken. It's been rinse and repeat for years.

What the chart shows:

- Accumulation Phase (2023–2025): XRP has been trading in a tight range with low volatility—classic accumulation behavior where major players build positions without moving the market

- Breakout Potential: Every previous accumulation zone has led to a rapid vertical move once the range broke, followed by a new distribution area

- Cycle Repetition: The right side of the chart projects another potential breakout transition, suggesting a significant upward move could be on the horizon once this range resolves

This repetition isn't random. It lines up perfectly with the Wyckoff accumulation schematic, confirming that XRP's price action remains consistent with institutional buying patterns and controlled liquidity building.

2017 Redux: Same Setup, Different Market

The current chart looks strikingly similar to 2017, when XRP traded sideways for months before breaking out and rallying hard. But there's a crucial difference this time around. The market in 2025 is fundamentally stronger than it was back then. Liquidity is deeper, institutional participation is higher, and regulatory clarity around XRP has improved dramatically. This makes the current accumulation phase less speculative and more technically solid. The Wyckoff setup now appears not just hopeful but structurally reinforced—a sign that when price finally breaks out of this zone, the move could have real staying power.

Beyond the technical chart, several factors support the bullish case. The crypto market cycle is entering a recovery phase as macro sentiment improves and capital flows back into risk assets. Bitcoin's 2025 halving could inject fresh liquidity and attention into altcoins like XRP. And perhaps most importantly, the regulatory fog around XRP has lifted considerably, reducing uncertainty and opening the door for larger institutional capital. These external catalysts add weight to the Wyckoff accumulation thesis, suggesting that technical strength and fundamental momentum may align at the same time.

Peter Smith

Peter Smith

Peter Smith

Peter Smith