While retail traders watch the daily candles, whales are making their move. On-chain data reveals that major XRP holders - wallets sitting on 10 million to 100 million tokens - have accumulated roughly 120 million XRP in just 72 hours.

What the Data Shows

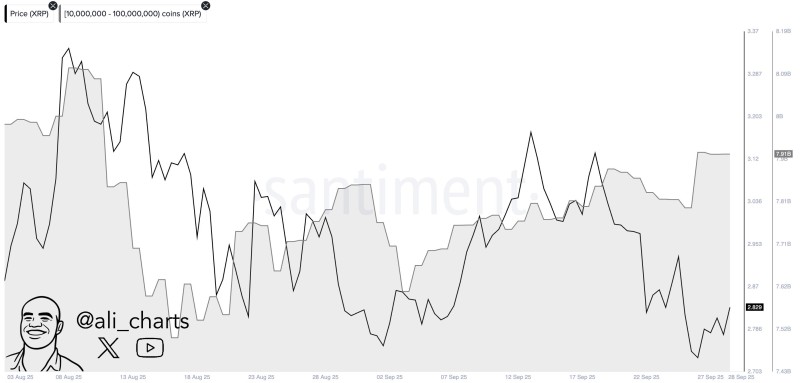

Market analyst Ali caught the pattern first, and the numbers tell a compelling story about what large investors are thinking right now.

The chart paints an interesting picture. XRP's price has been choppy through late August and September, bouncing around without clear direction. But underneath that noise, something else is happening - whale holdings have been climbing steadily back toward 7.9 billion tokens. That's classic accumulation behavior: buying when everyone else is uncertain. These aren't random buys either. The timing suggests deliberate positioning, with large holders adding to their bags while prices consolidate after recent drops.

Why Smart Money Is Buying

Three things are driving this whale activity. Ripple's legal battles with the SEC have largely gone in their favor, killing off a major risk that hung over XRP for years. The company's cross-border payment solutions are actually being used - this isn't speculative tech anymore, it's live infrastructure with real partnerships. And from a pure trading perspective, current price levels look like a discount after the volatility we've seen. When whales buy during consolidation, they're usually not thinking about next week - they're thinking about the next big move.

The technical picture is setting up. XRP is holding above $0.50, which has become the line in the sand. Break through $0.60-$0.65 with volume, and things could get interesting fast. History shows that when whales accumulate during quiet periods like this, price often follows their lead eventually. The question isn't whether they're positioning - the data already confirms that. The question is what they see coming that the rest of the market doesn't yet.

Usman Salis

Usman Salis

Usman Salis

Usman Salis