Something unusual is happening with XRP. While the price has been stuck between $0.50 and $0.60 for months, whale wallets have been buying at a pace we've never seen before.

The Accumulation Pattern

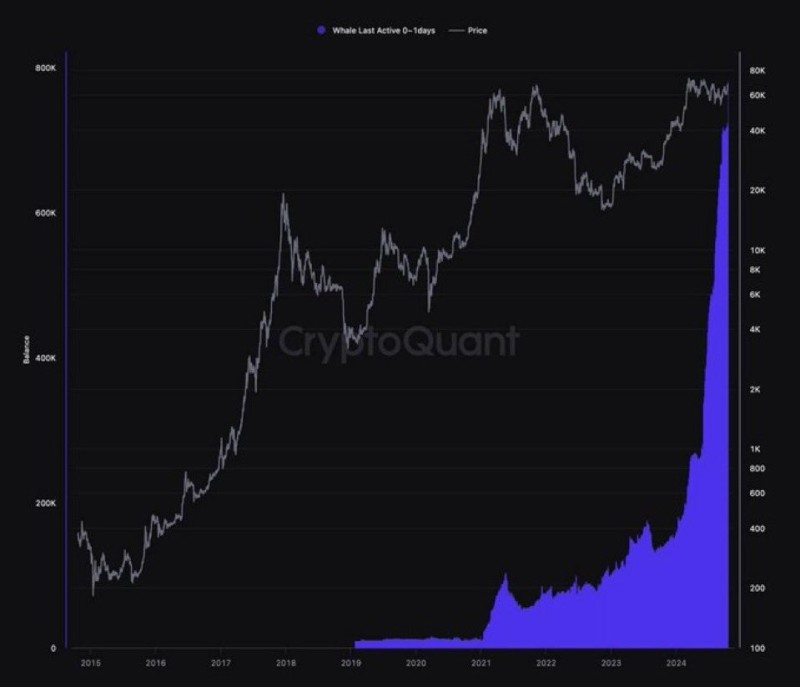

CryptoQuant data reveals a parabolic spike in whale activity throughout 2023 and 2024, creating a striking divergence that analyst That Martini Guy ₿ flagged as potentially significant. The gray line on the chart stays flat while whale balances shoot toward record highs - a pattern that historically precedes major moves.

The on-chain data tells a clear story. Whale wallets that were active in the last 0-1 days have been steadily increasing their XRP holdings, reaching unprecedented levels. This kind of quiet accumulation typically happens when large investors believe something bigger is coming but don't want to drive the price up prematurely. While retail traders chase momentum elsewhere, whales are methodically building positions at these suppressed levels.

Why the sudden interest? Ripple's legal battles with the SEC are largely behind them, removing a massive cloud of uncertainty. The company keeps expanding its cross-border payment network, adding real utility that could drive long-term demand. And after watching Bitcoin and Ethereum rally while XRP languished, some whales might see it as an undervalued catch-up opportunity.

What This Means Going Forward

For traders watching these patterns, whale accumulation usually points one direction - up. If this trend continues and retail interest finally catches on, XRP could make a serious run toward $1.00 or higher. But there's a catch: if these whales are playing a shorter game or the broader market doesn't cooperate, we might just see more sideways action. Right now the data is undeniable - whales are loading up aggressively. Whether everyone else follows is the billion-dollar question.

Peter Smith

Peter Smith

Peter Smith

Peter Smith