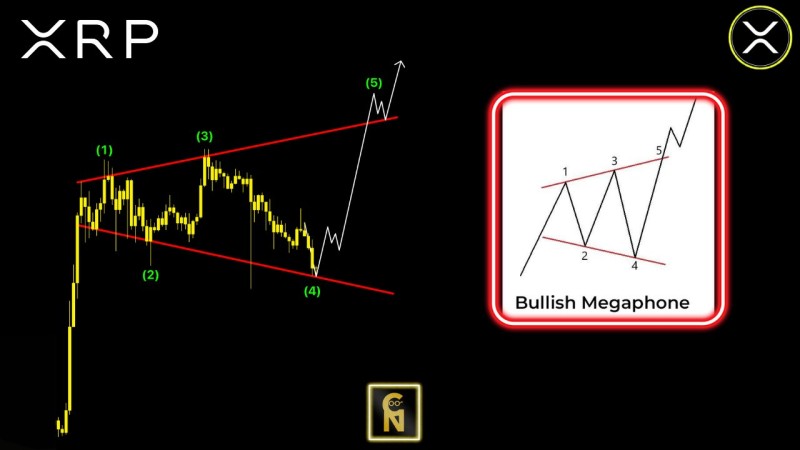

⬤ XRP has retreated to a technically significant zone following a broad correction inside a bullish megaphone structure. The chart shows an expanding pattern with higher highs and lower lows, with price now testing the lower boundary. This pullback aligns with what traders typically expect from a wave four correction, making the current zone critical for the asset's next move.

⬤ XRP has hit the exact lows projected for this phase, with $1.50 identified as the must-hold level. The chart clearly shows this zone lining up with the lower trendline of the expanding formation, where previous corrections found buyers. The wave count suggests that holding here is essential to confirm wave four is complete within the larger structure.

⬤ The setup presents a conditional scenario rather than a guaranteed outcome. If $1.50 support holds firm, the structure opens the door for a potential fifth expansion wave within the megaphone. But the chart explicitly warns that losing this support would kill the pattern entirely. This creates a binary situation where price action at one specific level determines whether the broader bullish framework stays valid.

⬤ This moment carries weight for XRP's technical outlook because bullish megaphone patterns require strict respect of support and resistance boundaries. How price behaves at $1.50 will decide if the expanding pattern continues or collapses. A solid hold preserves the existing structure, while a clean break below forces traders to scrap the current analysis and reassess trend direction. With XRP sitting right at this critical line, the next few sessions will determine which path the asset takes.

Peter Smith

Peter Smith

Peter Smith

Peter Smith