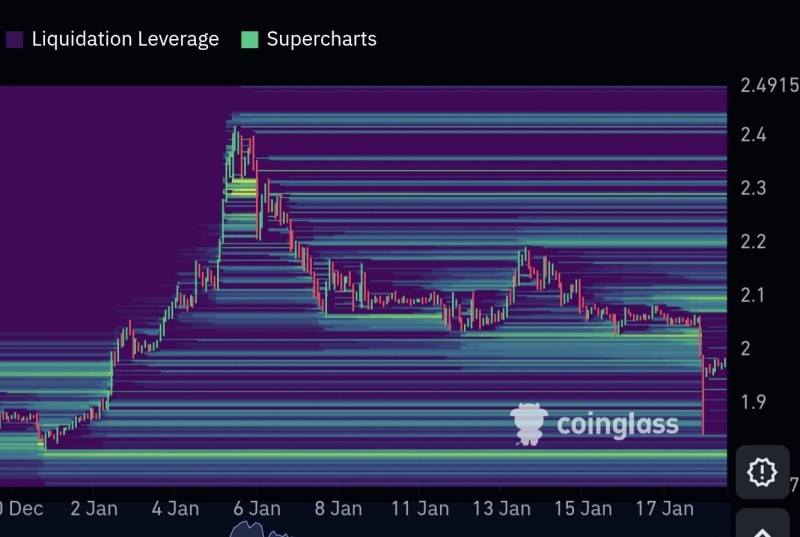

⬤ XRP has been spinning its wheels after a recent drop, with everyone's eyes locked on a fat layer of buy-side liquidity sitting just above where it's trading now. The $2.10 mark is the line in the sand that needs to get crossed before any real recovery can even think about starting. Chart data shows this zone packed with liquidity above price, making it a crucial technical barrier rather than some easy breakout level waiting to happen.

⬤ Looking at recent price movement, XRP was riding higher before flipping around and settling into a choppy, lower range. Since then, it's been bouncing around the $2.00 neighborhood with plenty of false starts and hesitation written all over the charts. That concentration of buy orders stacked above $2.10 tells you sellers have been doing their job keeping the coin from pushing higher—classic consolidation patterns when the market can't make up its mind.

⬤ "Liquidity bands on the chart appear layered above current price, signaling multiple levels where orders may be triggered if XRP moves higher," showing just how many potential resistance points are waiting overhead. Meanwhile, the downside looks more evenly spread out without any obvious floor level screaming for attention. This setup basically confirms XRP is range-bound right now, with neither bulls nor bears able to land a knockout punch.

⬤ Why should the broader crypto market care about XRP sitting in limbo? Because this coin tends to make explosive moves when it finally hits major liquidity zones. Extended consolidation below resistance like this keeps volatility cooking while everyone waits for clarity. Whether XRP finally breaks through $2.10 or keeps bouncing off it could shift sentiment across other large-cap cryptos, especially if it either absorbs all that overhead liquidity or just keeps grinding lower.

Usman Salis

Usman Salis

Usman Salis

Usman Salis