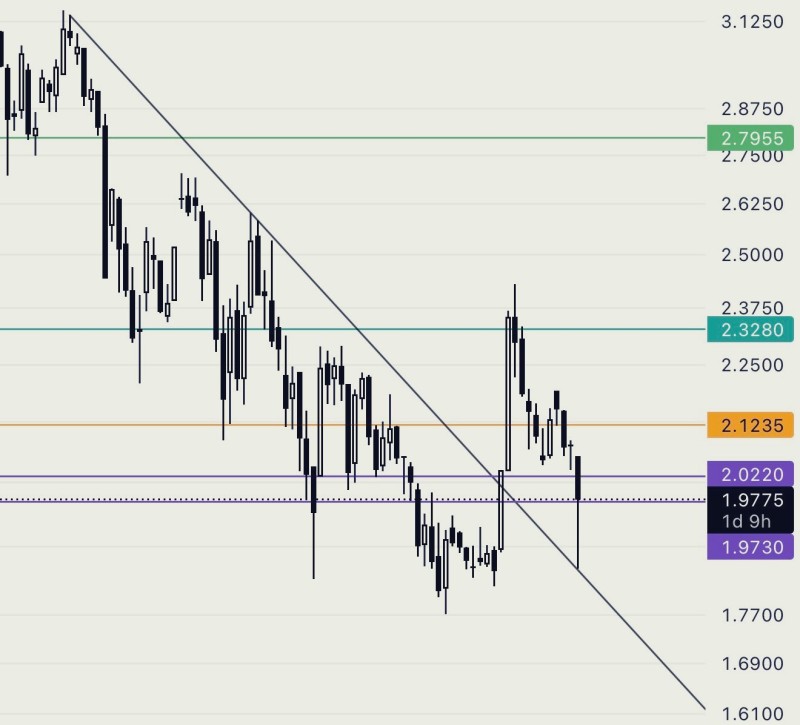

⬤ XRP has finished a crucial technical checkpoint after bouncing back to retest its daily trend on CME data and closing that four-hour gap everyone was watching. The charts show the correction phase is basically done, with price action pulling back into those previously marked support zones while dancing around a descending trendline that's been calling the shots lately.

⬤ The setup played out pretty cleanly—XRP was sliding lower in a clear downtrend before suddenly shooting up to fill that four-hour gap. Then it did exactly what traders expected: came back down to retest the broken area, gravitating toward that descending trendline and horizontal levels sitting around $2.02 and $1.97. These price zones got hammered with action, showing multiple candle wicks and closes clustered right there, proving they actually matter.

⬤ After filling the gap, XRP dipped again but managed to hold its ground above that lower support region near $1.97 without completely cracking. "The candles near this area suggest stabilization rather than continuation to the downside," showing that buyers stepped in when it counted. The whole structure suggests the daily trend retest played out respectfully at key technical levels instead of collapsing through them.

⬤ Here's why this matters beyond just XRP holders: the crypto market watches XRP like a hawk for signs of where short-term trends are heading. When a major coin finishes a trend retest and gap fill cleanly, it clears up technical confusion and basically sets the table for whatever move comes next. How XRP handles this consolidation zone could easily ripple through sentiment and volatility across the entire crypto space.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah