The cryptocurrency market has been witnessing renewed interest in XRP (Ripple) as the digital asset demonstrates resilience following recent market volatility. With institutional investors showing increased confidence and allocating significant capital to the token, XRP appears positioned for a potential breakthrough toward the psychologically important $3 price level. However, this bullish momentum faces substantial headwinds from heightened selling pressure, creating a complex technical landscape that traders and investors are closely monitoring.

XRP Institutions Drive Bullish Sentiment Despite Market Uncertainty

Institutional adoption has emerged as a key driver behind XRP's recent price stability and growth prospects. The data reveals a compelling narrative of professional money managers increasing their exposure to the digital asset, suggesting a fundamental shift in how traditional finance views Ripple's native token.

In a remarkable display of institutional confidence, XRP attracted an impressive $14.7 million in inflows during just the first week of the month. This substantial investment flow positioned XRP as the second-most favored altcoin among institutional investors, trailing only behind Solana's $16.1 million in inflows. The significance of this development cannot be overstated, as it demonstrates that despite ongoing market uncertainties and regulatory discussions, sophisticated investors continue to view XRP as a viable long-term investment vehicle.

These institutional inflows represent more than just capital allocation – they signal a growing recognition of XRP's utility and potential within the broader cryptocurrency ecosystem. Professional money managers, who typically conduct extensive due diligence before making investment decisions, appear convinced of XRP's fundamental value proposition. Their continued support could serve as a crucial stabilizing force against retail selling pressure, potentially providing the foundation needed for XRP to maintain its upward trajectory and challenge the $3 resistance level.

The $700M Problem: Why XRP (Ripple) Traders Are Heading for the Exits

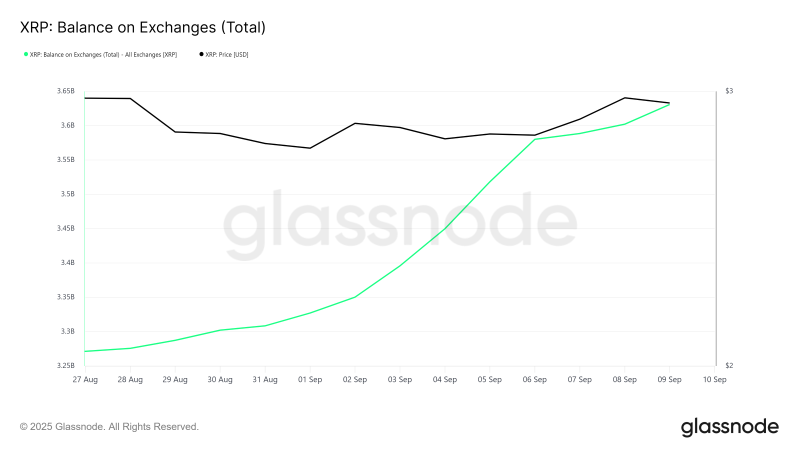

But here's where things get messy. While institutions are buying, regular traders are doing the opposite. Over 235 million XRP tokens - worth more than $693 million - got moved to exchanges just this past week.

When crypto moves to exchanges in bulk like this, it's usually not good news. It means people are getting ready to sell, and that's a lot of selling pressure waiting to hit the market.

Some of this is probably just profit-taking. XRP has had some decent runs lately, and smart traders know when to cash out. But there's also broader market fear playing a role here - people are nervous about where crypto is heading overall.

XRP Price Prediction: The Make-or-Break Moment at $2.95

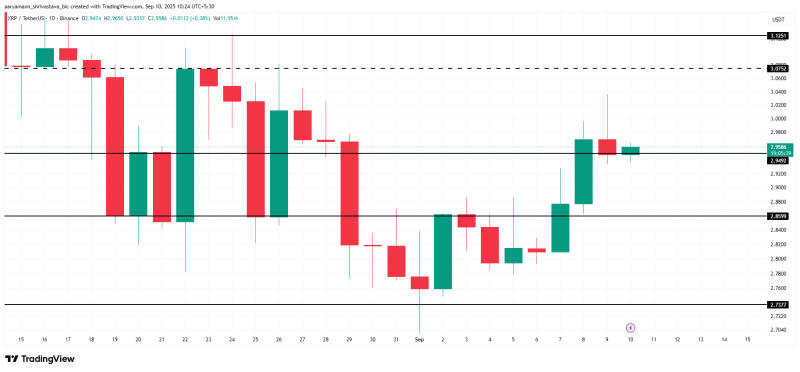

Right now, XRP is trading at $2.95, sitting right on the edge of its support at $2.94. It's literally a coin flip which way this goes next.

If the sellers win out, we could see XRP drop back to test $2.85 support. That would put the dream of hitting $3 on hold for a while. But if the institutional buyers keep stepping in and current holders decide to diamond hand instead of panic selling, XRP could flip $2.95 into solid support and make a real run at $3.07.

Breaking above $3.07 would be huge - it would basically tell the market that the bulls are back in control and could trigger more buying from traders who've been waiting on the sidelines.

Peter Smith

Peter Smith

Peter Smith

Peter Smith