XRP (Ripple) has captured renewed attention as speculative activity intensifies across derivatives markets. Fresh data from Binance shows leverage ratios hitting new weekly peaks, signaling growing confidence among traders who are betting heavily on a potential price breakout. This aggressive positioning comes as the token hovers near psychologically important resistance levels.

Leverage Ratio Surges to 0.325

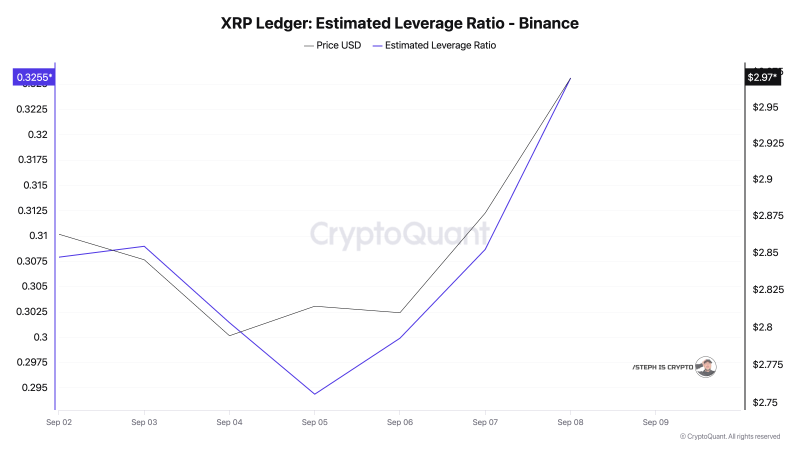

The Estimated Leverage Ratio (ELR) has climbed to 0.325, marking the highest weekly reading. This metric measures how much borrowed capital traders are deploying relative to their account balances, with elevated readings typically indicating increased risk appetite and bullish speculation.

Data tracked by STEPH IS CRYPTO shows the surge coincides with XRP's price recovery to $2.97, suggesting that leveraged long positions are helping fuel the current momentum.

This parallel movement between price and leverage exposure points to traders doubling down on their bullish bets using borrowed funds.

Market Dynamics and Risk Assessment

The recent price action reveals an interesting pattern where both XRP's value and leverage ratios experienced a notable dip between September 2-5 before staging a sharp reversal. This synchronized recovery suggests coordinated buying interest, particularly from traders willing to amplify their positions through leverage. However, the elevated borrowing levels also introduce significant downside risk, as any meaningful price correction could trigger cascading liquidations that amplify selling pressure.

What's Driving the Bullish Sentiment

Several factors appear to be converging to support this aggressive positioning. The broader cryptocurrency market has shown signs of recovery, lifting sentiment across altcoins including XRP. Additionally, there's been increased institutional engagement with the XRP Ledger ecosystem, providing fundamental support for higher valuations. Many speculators are also positioning ahead of what they view as an inevitable break above the psychological $3.00 resistance level, creating a self-reinforcing cycle of bullish expectations.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah