XRP started the year strong, but that momentum has clearly faded. The token is now dealing with fresh selling pressure, and technical indicators point to a deeper pullback ahead.

Price Action Shows Weakness

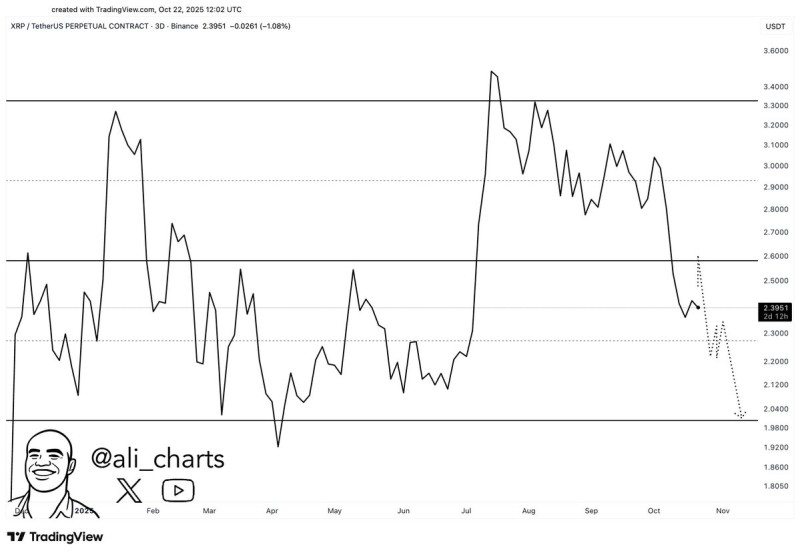

XRP's recent moves have disappointed those hoping for a rally. The coin hasn't been able to hold above $2.60, getting pushed back every time it approaches that level. According to Ali analysis on the 3-day timeframe, XRP is currently trading around $2.39 and trending down. The projected path suggests more downside ahead, with $2.00 standing out as the next likely destination if sellers keep control.

The chart reveals a bearish setup with several important price zones: Resistance sits at $2.60, where upward attempts have repeatedly failed. The current trading zone around $2.39 offers some support but hasn't shown much bounce strength. Below that, $2.00 represents the key support target that analysts are watching closely as either a potential reversal point or breakdown zone. If XRP drops below $2.30, it could quickly accelerate toward $2.00. A short-term bounce is still possible if the price manages to climb back above $2.50.

Why the Decline Is Happening

Several factors are driving XRP's weakness right now. The broader crypto market has cooled off as traders rotate back into Bitcoin, pulling liquidity away from altcoins. Many investors who bought during earlier rallies are now taking profits before the next quarterly cycle. Regulatory uncertainty continues to hang over the market—despite Ripple's partial legal wins, the ongoing debate still affects sentiment. Trading volume and futures open interest for XRP have both dropped, showing that speculative interest is fading. These combined forces suggest the decline isn't just technical but reflects broader market caution.

For XRP to reverse course, we'd need to see a few key changes. A clean break above $2.60 would signal that the downtrend is breaking. Rising volume and buyer participation would indicate renewed confidence. Positive news from Ripple—like new institutional partnerships or adoption milestones—could spark interest. Without these catalysts, the bearish outlook stays in place, and lower levels remain likely before any real recovery begins.

The $2.00 support is now the most important level for XRP traders to watch. If it holds, buyers might step in and build a base for a rebound. But if it breaks cleanly, the token could fall further toward $1.85 or below. Despite the current weakness, long-term holders see this pullback as a normal correction after XRP's impressive rally earlier in 2025. Whether this is just a pause or the start of something deeper will depend on how the market responds at $2.00.

Peter Smith

Peter Smith

Peter Smith

Peter Smith