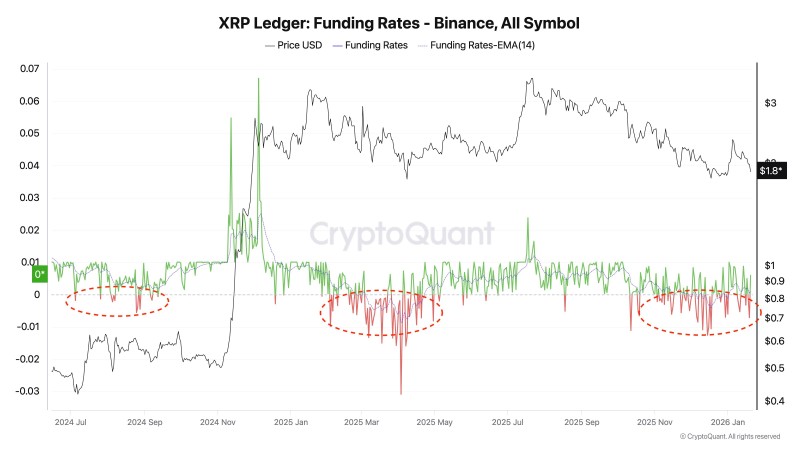

⬤ XRP derivatives markets are showing a noticeable shift in trader sentiment. Funding rates on Binance futures have flipped negative, meaning more traders are opening short positions. This bearish tilt comes as XRP keeps trading below $2—a level that used to act as support but now feels out of reach.

⬤ Data from CryptoQuant reveals funding rates have been dipping into negative territory since late 2025, staying there for longer stretches. When funding rates go negative, it means short sellers are actually paying a fee to keep their bets open. Right now, XRP is hovering around $1.80, struggling to find footing after losing momentum.

⬤ The current weakness is a sharp turnaround from early January, when XRP rallied nearly 30% and hit a local peak near $2.41 on January 6. That move looked promising at first, helping the token recover some ground lost in late 2025. But the rally ran into a wall just above $2 and hasn't been able to push through since.

⬤ Why does this matter? Funding rates give us a window into how traders are positioned and where sentiment is heading. When funding stays negative for a while, it usually means a lot of people are betting on further downside. If too many traders pile into shorts, it can set up wild price swings if something suddenly shifts. For now, XRP remains stuck below $2, and how traders position themselves in the futures market could shape what happens next.

Alex Dudov

Alex Dudov

Alex Dudov

Alex Dudov