When XRP crashed over 50% on Binance Futures in a matter of minutes, it wasn't just another volatile day in crypto—it was a stark demonstration of how fragile liquidity can be, even in seemingly stable markets. What looked like a deep, healthy orderbook evaporated almost instantly, triggering mass liquidations and a price collapse from $2.50 to $1.19.

The Illusion of Stability

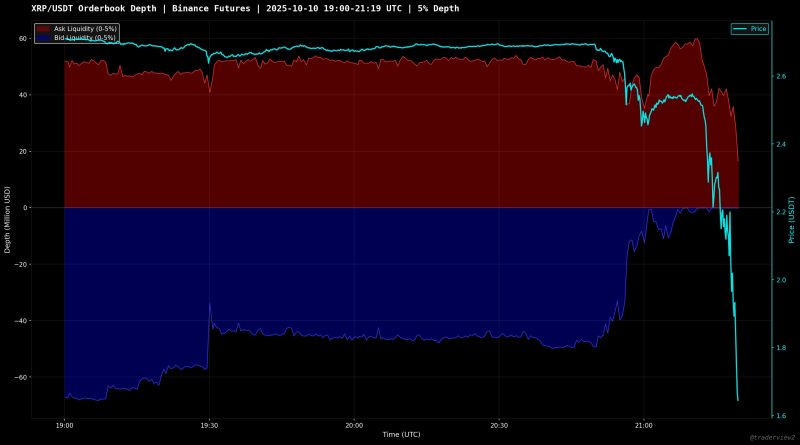

According to analysis from Dom, the XRP/USDT orderbook appeared robust for hours before the crash. Both sides of the book showed $50-60 million in liquidity within 5% of the price, suggesting a well-supported market with plenty of depth.

But that stability was deceptive. Just before 21:00 UTC, roughly $20 million in market sell orders hit the exchange. The bid side—previously showing nearly $50 million in buy orders—collapsed to almost nothing. The ask side briefly spiked as market makers tried to reposition, but it wasn't enough. Within ten minutes, the price had cratered from $2.50 to $1.19 as over $50 million in sells and forced liquidations overwhelmed what remained of the orderbook.

Why Market Makers Disappeared

The real problem wasn't just aggressive selling—it was that market makers vanished when they were needed most. Facing extreme volatility, these liquidity providers either pulled their orders to limit losses or simply chose not to step back in. Without them, the orderbook became dangerously thin, creating what traders call a "liquidity air pocket" where there's nothing to stop a falling price.

This isn't unique to XRP. It's a structural weakness across crypto markets: liquidity that looks deep on the surface can disappear in seconds during stress events, leaving traders exposed to extreme price swings and cascading liquidations.

What This Means Going Forward

Key takeaways from the crash:

- Orderbook depth can be misleading—what appears stable may vanish instantly under pressure

- High leverage amplifies these moves, turning sharp drops into catastrophic liquidation cascades

- Even major tokens remain vulnerable when liquidity providers step aside

- Market makers hold enormous power over price stability, and their absence creates dangerous conditions

For XRP specifically, rebuilding confidence and attracting liquidity back to the market will be essential. For traders more broadly, this serves as a reminder that crypto markets remain far more fragile than traditional markets, particularly on derivatives platforms where leverage and automated liquidations can accelerate moves beyond what fundamentals would suggest.

The crash wasn't just a price event—it was a lesson in market structure that every crypto trader should understand.

Peter Smith

Peter Smith

Peter Smith

Peter Smith