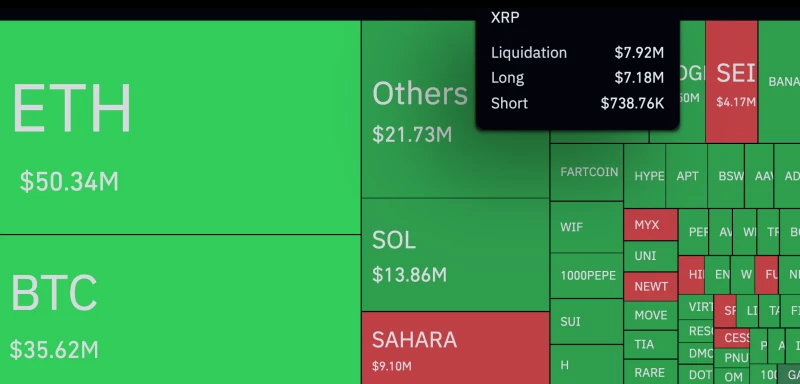

XRP just witnessed one of the most lopsided liquidation events the crypto market has seen in ages. According to CoinGlass data, long traders got absolutely destroyed with $7.18 million in liquidations, while shorts barely felt a scratch at just $738,000. That's not just uneven - it's a staggering 1,000% imbalance that left XRP bulls wondering what hit them.

Here's the kicker: it didn't even take a major crash to trigger this carnage. XRP only dropped around 4%, which is basically a Tuesday in crypto. But when you've got a market packed with bullish bets and everyone's leaning the same way, even a small pullback can turn into a nightmare. The price dipped just enough to start knocking out overleveraged positions, and it snowballed from there.

XRP (Ripple) Stands Out Among Major Crypto Liquidations

Sure, other big cryptos saw heavy liquidations too. ETH hit $50.34 million and BTC reached $35.62 million in liquidated positions. But here's what makes XRP different - neither of those coins came close to this kind of brutal imbalance between longs and shorts. The XRP market had turned into a one-way street where everyone was betting up, and when reality hit, there was nobody left to catch the falling knife.

XRP (Ripple) Market Learns Expensive Lesson About Overexposure

This whole mess was textbook market psychology gone wrong. You had heavy optimism, zero downside protection, and traders piling into the same side without thinking about what could go wrong. The 1,000% liquidation gap didn't happen because of some black swan event or crazy volatility. It happened because too many people made the same bet, and when the music stopped, there weren't enough chairs to go around.

XRP didn't need to crash hard to wipe out these positions. The bulls had already set themselves up for failure by getting way too overexposed. All the market had to do was shrug, and they collapsed under their own weight. It's a harsh reminder that in crypto, following the crowd without proper risk management can turn a small dip into a financial disaster.

Peter Smith

Peter Smith

Peter Smith

Peter Smith