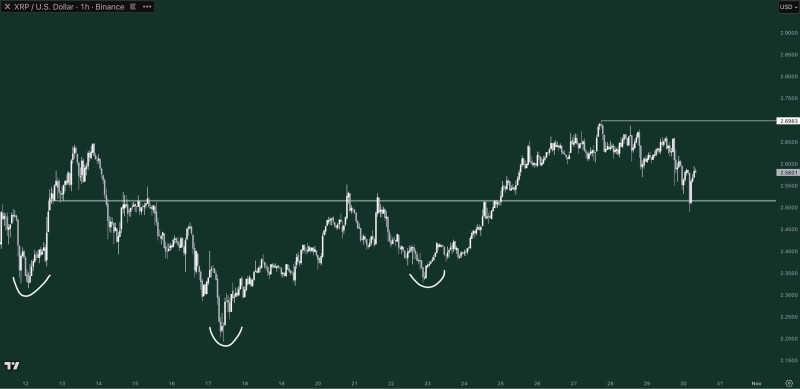

XRP is showing renewed strength after holding a critical support level on its hourly chart. The token appears stable above the $2.55 zone — an area that previously acted as resistance — and may now be gearing up for another push toward $2.69. The technical picture suggests buyers are stepping in aggressively, hinting that short-term momentum could soon tilt back in favor of bulls.

XRP Price Finds Solid Ground Near Key Support

According to trader Gordon's recent analysis, the chart shows XRP reclaiming support around $2.54–$2.56, with multiple bounce attempts in recent sessions. Each dip below this zone has triggered quick recoveries, highlighting strong buying interest.

The pattern forming on the hourly timeframe resembles an inverse head and shoulders structure — a setup often linked to trend reversals. This typically signals fading bearish pressure and suggests the asset may soon challenge higher resistance levels. Right now, XRP is consolidating near $2.58, with the next visible barrier at $2.69, aligning with previous local highs and serving as the immediate upside target.

Market Context and Technical Interpretation

XRP's ability to hold around $2.55 reflects the asset's tendency to draw solid demand near established support zones. The brief dip below this level looks like a liquidity sweep — a tactical move to trigger stop-losses and gather market liquidity before reversing higher. Momentum stays constructive as long as XRP keeps closing above $2.54. If bulls maintain their grip, a retest of $2.69 resistance could mark the beginning of a short-term recovery phase. That said, losing support would likely shift attention toward the next demand area near $2.48–$2.50, where prior reaction wicks show buyer presence.

Key Levels to Watch

- Support Zone: $2.54–$2.56

- Immediate Resistance: $2.69

- Secondary Target: $2.72–$2.75 (on confirmed breakout)

- Invalidation Level: sustained close below $2.50

These technical markers give traders clear reference points for short-term positioning. The overall bias leans cautiously bullish, backed by consistent bounces and preservation of higher lows.

Sergey Diakov

Sergey Diakov

Sergey Diakov

Sergey Diakov