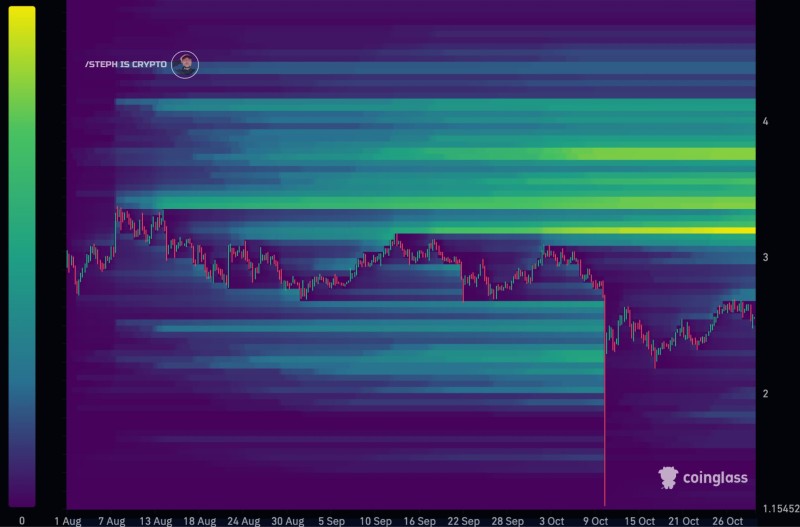

The XRP (Ripple) market is showing early signs of strategic positioning as a substantial liquidity cluster forms near the $3.6 mark. Recent heatmap data from Coinglass highlights a notable expansion of capital concentration in this zone, hinting that market makers and larger holders might be gearing up for a directional shift. This concentration of orders offers insight into where price action could head next.

Growing Liquidity Around $3.6

Trader Steph Is Crypto recently shared data showing that liquidity density—visible as bright yellow and green zones on the heatmap—is intensifying between $3.4 and $3.6. This buildup suggests traders are stacking orders in anticipation of price reaching this area.

In market structure terms, dense liquidity pockets like this often act as magnets, pulling price toward them as liquidity providers adjust their positions and large participants hunt for fills. Right now, XRP trades below this zone after stabilizing from a sharp October correction that saw it bounce from around $1.15. The expanding liquidity signals growing interest at these higher levels—typically an early indicator of institutional involvement or algorithmic liquidity preparation before volatility picks up again.

Why Liquidity Is Building Here

Several factors could explain this sudden concentration of orders:

- Institutional Activity: High-liquidity zones often indicate large funds or OTC desks preparing for significant trades

- Post-Consolidation Setup: After weeks of sideways movement, XRP appears to be coiling for its next volatility expansion

- Renewed Market Interest: Improving sentiment around Ripple's ecosystem and the broader crypto market has rekindled attention on mid-cap altcoins like XRP

As analyst note, this pattern resembles a classic accumulation phase where strength builds before a decisive breakout or breakdown.

Technical Picture

XRP continues trading within a defined range, with support holding near $1.10–$1.20 and resistance aligning with the $3.4–$3.6 liquidity cluster. A clean push into this upper zone could spark short-term volatility as resting orders get filled. If momentum carries through that threshold, the next psychological barrier sits near $4. However, if the liquidity gets absorbed without follow-through, the market might pull back toward previous accumulation areas around $2.0–$2.2.

Usman Salis

Usman Salis

Usman Salis

Usman Salis