Solana (SOL) been on fire lately – up a whopping 37% this month alone. Everyone's talking about SOL's epic run, but here's what most people aren't seeing: the smart money is quietly heading for the exits.

While retail traders are celebrating new highs, data shows that pretty much every major holder group has been trimming their positions. It's like watching a party where all the VIPs are sneaking out the back door while everyone else is still dancing.

The Numbers Don't Lie: SOL Whales Are Dumping Hard

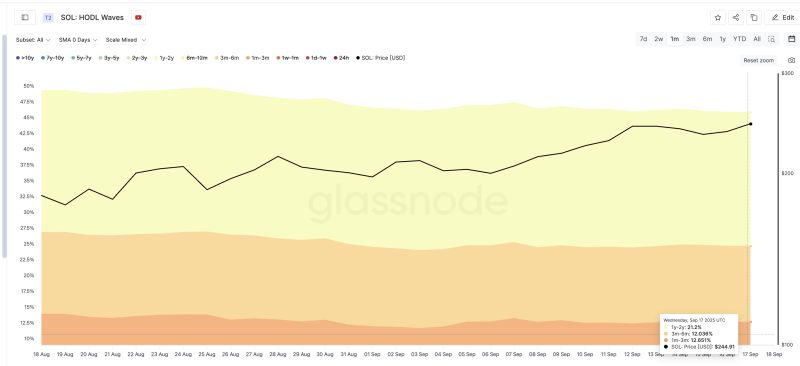

Here's where things get interesting. HODL Waves data – which basically tracks who's holding what and for how long – shows that almost every single holder group has been selling over the past month. And we're not talking small amounts here.

The 1-3 month holders dropped their share from 13.93% of total supply on August 18 down to 12.65% now. The 3-6 month crew went from 12.92% to 12.03%. Even the diamond hands (1-2 year holders) reduced their positions from 22.51% to 21.20%. When even the long-term believers are selling, you know something's up.

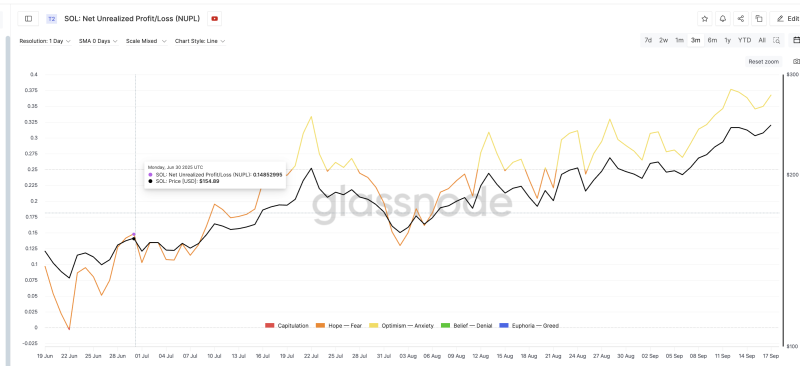

But here's the kicker – the Net Unrealized Profit and Loss (NUPL) is sitting at a dangerous 0.36. This metric shows how many wallets are sitting pretty with paper profits, and when it gets this high, it usually means trouble is brewing.

Remember what happened on September 12 when NUPL hit 0.37? SOL tanked over 3%. And back on July 22, when NUPL reached 0.33, we saw a brutal 22.9% drop from $205 to $158. Right now, we're basically at those same danger levels again.

SOL Price Charts Are Flashing Red Alerts

The technical picture isn't looking much better. Sure, on the daily chart, SOL's breakout from an ascending channel is pointing toward a tasty $284 target. But there's a big "if" here – SOL needs to crack $249 first, and it's struggling.

The real concern is what's happening on the two-day chart. SOL is trapped in a rising wedge, and anyone who's been trading crypto for a while knows that's usually bad news. Rising wedges have this nasty habit of leading to sharp corrections.

Making matters worse, the RSI is showing bearish divergence. While SOL keeps hitting new highs, the RSI is making lower highs. It's like watching a runner who looks strong from the outside but is actually running out of breath.

If SOL can somehow blast through $249 on a two-day close, bulls might be back in business. But if it fails? Well, things could get ugly fast. First stop would likely be $227, and if that breaks, we're looking at $202 – or even lower.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah