The decentralized finance landscape continues to evolve rapidly, with newer blockchain platforms challenging established players for market dominance. Among these emerging ecosystems, Sei has recently captured significant attention from investors and developers alike, demonstrating remarkable growth that positions it as one of the most promising DeFi platforms of 2025.

Explosive Growth in the SEI Ecosystem

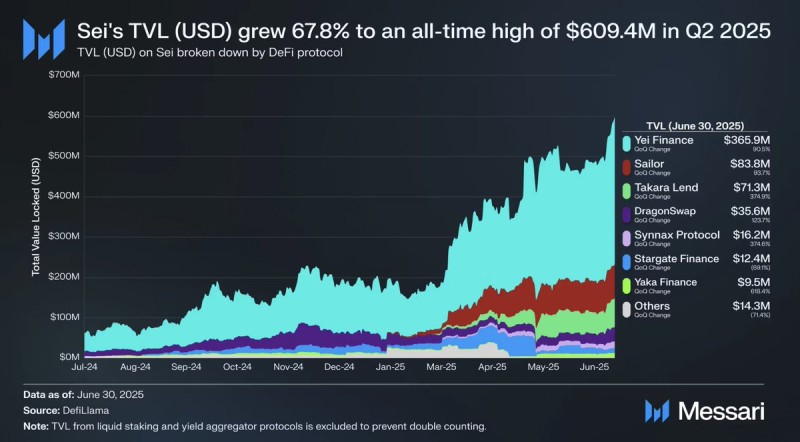

In a recent tweet, Coin Bureau highlighted the remarkable expansion of Sei’s DeFi sector, with total value locked (TVL) jumping 67.8% in Q2 2025 to hit an all-time high of $609.4 millionThis surge reflects rapidly growing confidence in Sei as a blockchain platform for decentralized finance, placing it among the fastest-expanding ecosystems this year.

The growth wasn't concentrated in just one protocol but spread across the entire ecosystem. Yei Finance leads the pack with $365.9M TVL, representing a 90.5% quarter-over-quarter increase. Meanwhile, Sailor and Takara Lend contributed $83.8M and $71.3M respectively, with growth rates of 93.7% and an impressive 374.9%. Even smaller protocols like Yaka Finance saw explosive 618.4% growth, reaching $9.5M in TVL.

Key Growth Drivers

Several factors explain Sei's rapid expansion. DeFi innovation has been central, with a broad rollout of lending, trading, and yield protocols attracting diverse user bases. Rising capital inflows from both institutional and crypto-native investors have provided the liquidity needed for sustained growth.

Sei's technical advantages also play a crucial role - its low-latency, high-performance blockchain offers the scalability and cost efficiency that modern DeFi applications demand. Additionally, strategic ecosystem incentives through developer and liquidity programs have accelerated adoption across multiple protocols.

Looking Ahead

With Sei's TVL already surpassing $600M, the next psychological milestone of $700M could be within reach if current momentum continues through Q3. However, long-term success will depend on whether this liquidity growth translates into sustained user adoption, continued developer commitment, and proven protocol resilience during market volatility. The ecosystem's ability to maintain its current trajectory while building robust fundamentals will ultimately determine its position in the competitive DeFi landscape.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah