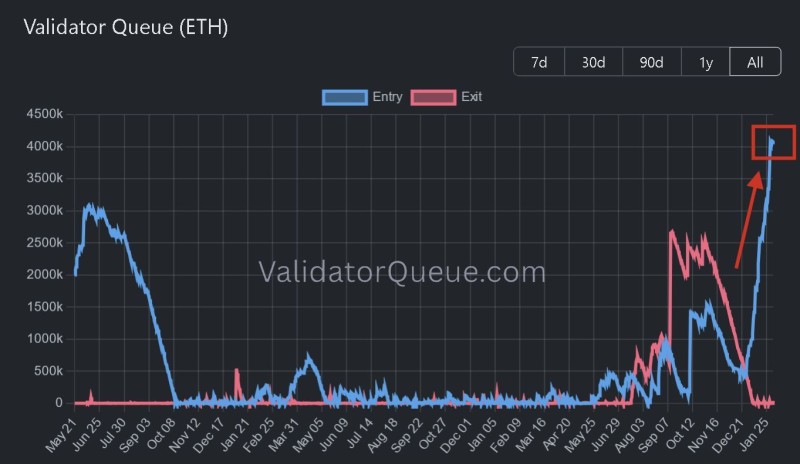

Ethereum validators are piling in at record levels. More than 4 million ETH is now waiting to enter the staking queue, creating a 71-day delay for new participants. Meanwhile, hardly anyone's leaving—exit queues are practically empty. It's a clear sign that long-term believers aren't backing down, even as ETH's price struggles to keep up with the enthusiasm.

Staking Queue Hits All-Time High with 4M ETH Waiting

Ethereum staking demand just went vertical. The validator entry queue has shot past 4 million ETH, while the exit side looks like a ghost town. Charts show pending validators climbing almost straight up, but the withdrawal queue? Nearly flat.

Right now, about 4,086,022 ETH is sitting in line to start staking, with an estimated wait of around 71 days before activation. On the flip side, only about 24,000 ETH is queued to leave. That's a massive gap—and it shows people are way more interested in locking up their coins than pulling them out.

This isn't the first time we've seen this pattern. Similar dynamics played out recently when the ETH staking queue hits 71 days and when validator exits drop to zero. Both times, growing delays reflected the same thing: strong, sustained demand for staking despite shaky price performance.

30% of ETH Supply Now Locked in Staking

Total staked Ethereum has climbed to roughly 36.6 million ETH—close to 30% of the entire circulating supply. The network is now running with about 975,000 active validators, and that number keeps growing. The data paints a picture of expanding participation with almost no one heading for the exits.

We saw comparable trends in the validator queue milestone article, where accumulation clearly outweighed withdrawals. It's becoming a recurring theme: more people want in, fewer want out.

"The chart shows a near vertical rise in pending validators while the exit queue remains almost empty."

How Staking Affects ETH Market Supply

Here's where things get interesting for the broader market. Ethereum's staking mechanism locks coins for extended periods, pulling them out of circulation. As more ETH gets committed to network security and withdrawal demand stays minimal, the amount of liquid ETH available in the market keeps shrinking.

That tightening supply could have ripple effects across the digital asset ecosystem. Less circulating ETH means different dynamics for traders, DeFi platforms, and anyone holding or using the asset. Whether that translates into price action remains to be seen—but the fundamentals are shifting either way.

Peter Smith

Peter Smith

Peter Smith

Peter Smith