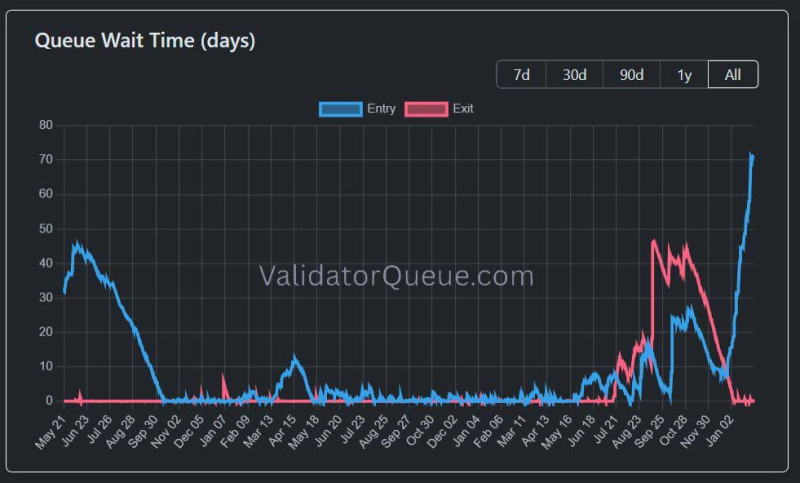

⬤ Ethereum staking just hit a major milestone with validator entry wait times climbing to roughly 71 days. The chart tracks a sharp jump in delays, showing a massive backlog of people lining up to stake their ETH. This expanding queue tells us participants are locking up capital for the long haul, not chasing quick profits or reacting to daily price moves.

⬤ ValidatorQueue.com data reveals how Ethereum's staking queue has changed over time—long stretches of minimal waits suddenly interrupted by demand spikes. Right now we're seeing one of those big surges, with entry times racing toward the 70-day mark. Meanwhile, the exit queue stays quiet, meaning validators aren't rushing to pull out their staked ETH despite whatever's happening in the markets.

⬤ When you stake on Ethereum, your ETH gets locked into the protocol, pulling liquid supply off the market. That 71-day wait shows demand is crushing the network's ability to onboard new validators fast enough. People are clearly willing to wait it out to secure their validator spots, treating staking like a serious long-term play instead of just another yield farm.

⬤ Why this matters: sustained staking growth impacts supply and market behavior. Long entry queues plus low exits signal confidence in Ethereum while reducing selling pressure by keeping ETH locked up. With validator activity showing strong participation and minimal withdrawals, Ethereum's network engagement looks solid. How long these wait times stick around could shape expectations about ETH availability and broader sentiment toward the ecosystem moving forward.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova