Something big is happening in the blockchain world. That puts it ahead of Solana and hot on Ethereum's heels. With the altcoin market sitting at $1.6 trillion, some analysts are throwing around a wild number: Hyperliquid's implied valuation could hit $533 billion, potentially driving its native token $HYPE toward $2,000.

How Hyperliquid Got Here

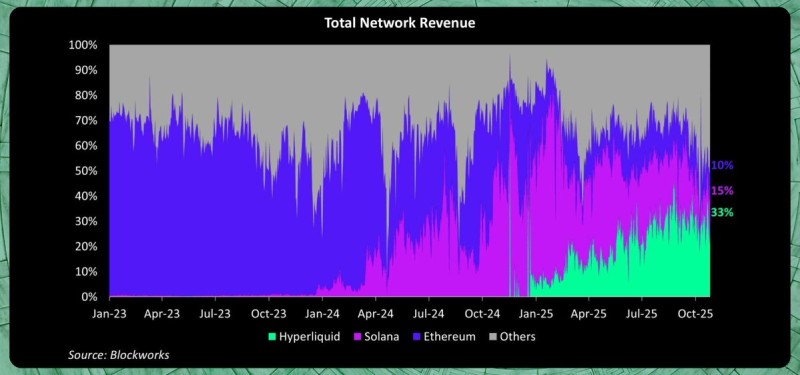

According to fresh data from HYPEconomist and Blockworks, Hyperliquid—a relatively new decentralized trading network—has skyrocketed to claim about 33% of all blockchain revenue. The numbers tell a striking story. Less than two years ago, Hyperliquid barely registered on the revenue charts. Now it's eating up a third of the entire pie. Ethereum (still the biggest single player) is losing ground, while Solana hovers around 15%. Smaller chains in the "Others" category keep shrinking—users are clearly flocking to the platforms that actually deliver.

The Blockworks chart tracking "Total Network Revenue" from early 2023 to late 2025 shows the shift clearly:

- 2023: Ethereum dominated with over 70% of blockchain fee revenue

- 2024: Solana gained momentum as Ethereum struggled with high gas fees; Hyperliquid started appearing on the radar

- 2025: The inflection point—Hyperliquid's bright green segment explodes upward, capturing one-third of the market while Ethereum steadily declines

This isn't just a visual change. It signals a fundamental redistribution of how transaction volume and protocol activity flow across blockchains.

The $533 Billion Question

Here's the logic: if Hyperliquid earns one-third of all blockchain revenue and the total altcoin market is worth $1.6 trillion, then by revenue share, Hyperliquid's "fair value" could be around $533 billion. That would make $HYPE one of the most valuable digital assets globally—potentially hitting $2,000 per token.

Sure, it's a theoretical calculation. But it reflects a growing shift among investors who are starting to care more about real revenue than hype and promises. Hyperliquid's edge? Lightning-fast order execution, minimal latency, and full on-chain transparency—exactly what DeFi traders have been craving beyond Ethereum's congested network.

Hyperliquid's rise puts serious pressure on the established players. Ethereum still leads in developer activity and infrastructure, but its fee structure and scaling challenges keep holding it back. Solana, despite being fast and efficient, hasn't matched Hyperliquid's revenue explosion.

If Hyperliquid keeps this up, we could be witnessing the first major reshuffling of blockchain revenue dominance since 2021—similar to when DeFi first took off.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah