Hyperliquid just dropped something that's got the entire DeFi space talking. Their new HYPE Engine is committing 97% of all protocol revenue to buying HYPE tokens from the open market – and it's already sitting on $1.2 billion worth of tokens with a 140% return.

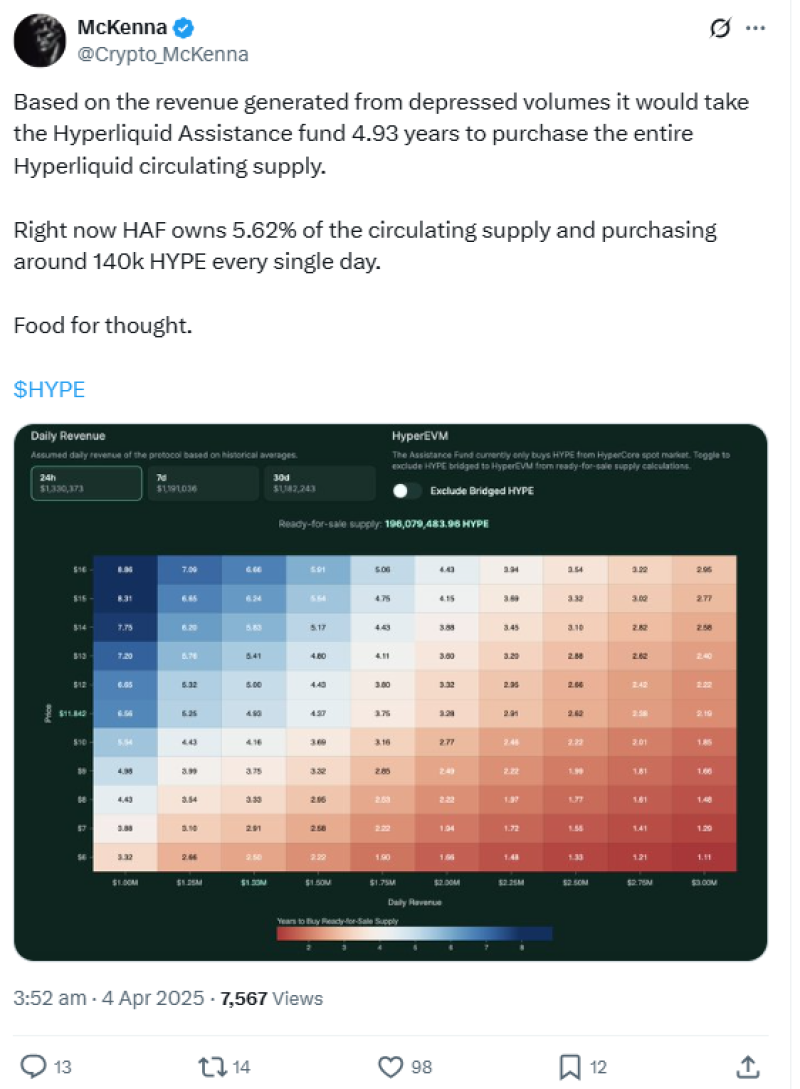

The numbers are wild. The platform's Assistance Fund now owns 5.62% of all circulating HYPE tokens, according to crypto analyst McKenna from Arete Capital. They're projecting annual purchase volumes could hit $1.5 billion soon, creating serious buying pressure.

What makes this different is how they're using those tokens. The HYPE Engine puts capital to work across validator infrastructure, DeFi strategies, and their Nest DEX. Their projections show $100 million deployed could generate $40 million in yearly fees, with half flowing back to fuel more buybacks.

HYPE Dominates On-Chain Trading Volume

The platform isn't just buying tokens – it's actually earning the revenue to back it up. Hyperliquid now controls over 80% of on-chain derivatives volume and more than 25% of Binance's open interest. Last July, they hit $319 billion in trading volume and captured 35% of all blockchain revenue that month.

Why HYPE Could Hit $100

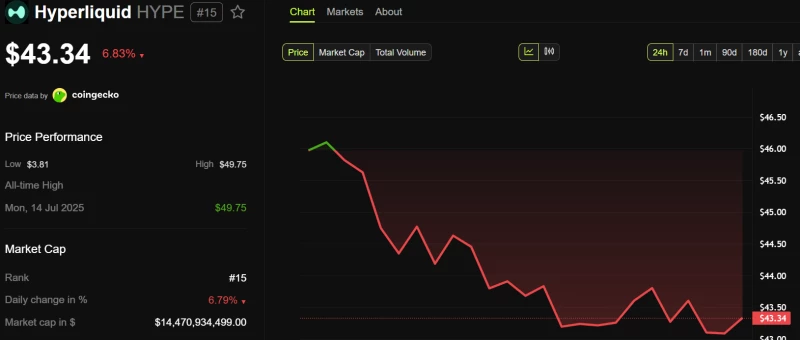

HYPE is trading at $43.34, up 7% in 24 hours. But traders think this is just the start. Popular trader Degen Ape says the cool-off phase is over and the road to $100 is now in "easy mode."

The HYPEconomist pointed out that Hyperliquid generated $4.6 million in fees on a "casual Monday." Yet prediction markets only give 46% odds for an $8 million fee day – seems conservative given the growth trajectory.

The upcoming HIP-3 upgrade will transform Hyperliquid from an exchange into full Web3 infrastructure, potentially driving more revenue into the buyback engine. With the Engine's yield strategies projecting 16-46% annual returns, the fundamentals could justify much higher valuations than current levels.

Usman Salis

Usman Salis

Usman Salis

Usman Salis