Ethereum might be setting up for something big. Despite currently trading at $4,477 and struggling with the $4,500 resistance, a perfect storm of bullish signals is brewing beneath the surface. Exchange balances are at their lowest point in nine years, and when everyone's scared, that's usually when ETH makes its boldest moves.

Why ETH Sentiment Could Fuel the Next Rally

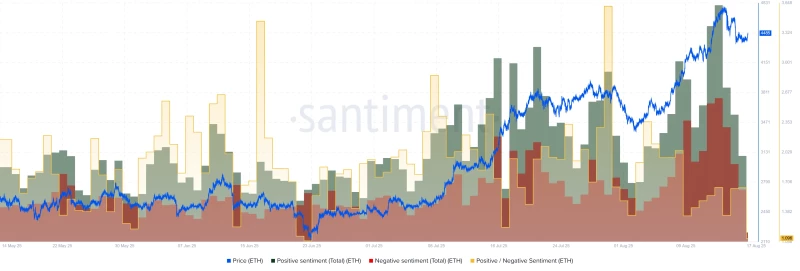

Here's the thing about crypto markets – they love catching people off guard. Right now, Ethereum's sentiment index sits below 2.00, which historically screams fear, uncertainty, and doubt. But here's the kicker: when retail traders are this pessimistic, prices often do the exact opposite of what everyone expects.

We've seen this movie before. Back on June 16, 2025, and again on July 30, 2025, Ethereum hit extreme greed levels. Both times? Sharp corrections followed as everyone rushed to take profits. Now we're dealing with the flip side – widespread doubt while ETH keeps pushing higher. It's like the market is building up energy for its next explosive move.

The psychology is simple: when fear dominates while fundamentals stay strong, smart money starts positioning for the inevitable turnaround.

Ethereum Supply Squeeze Tells the Real Story

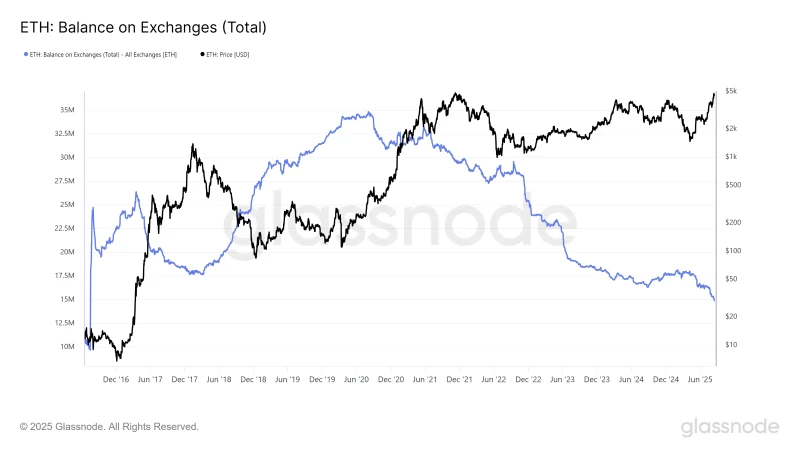

The most compelling piece of this puzzle? Exchange balances just dropped to 14.88 million ETH – the lowest we've seen in nine years. That's huge. When investors pull their tokens off exchanges, they're essentially saying "I'm not selling anytime soon."

This isn't just some minor trend either. Over the past week, about 470,000 ETH worth $211 million got scooped up and moved into cold storage. Sure, it's not the most aggressive accumulation we've ever seen, but it's steady and consistent. And in crypto, steady often beats flashy.

The math is pretty straightforward here. Less supply on exchanges + steady demand = upward pressure on price. It's the same pattern we saw before previous major ETH rallies, and history has a funny way of repeating itself in crypto.

What's Next for ETH Price Action

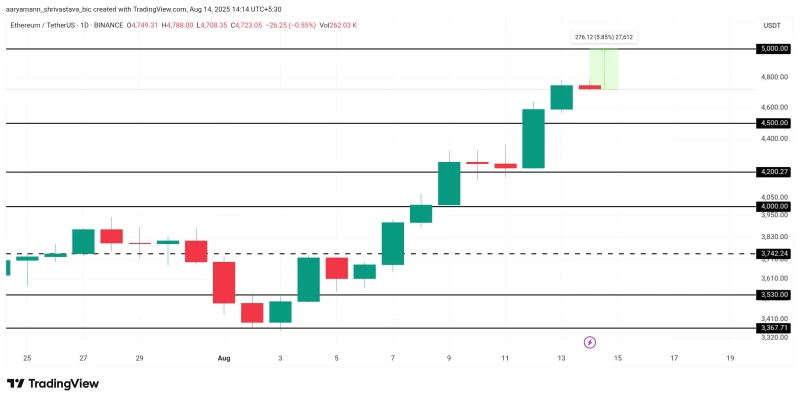

ETH is basically camping right below $4,500, and that level is going to make or break the next move. If bulls can flip this resistance into support, things could get interesting fast. The next stop would be $4,749, and after that? The big psychological level everyone's watching – $5,000.

Breaking $5,000 wouldn't just be a number on a chart. It would likely trigger serious FOMO and could spark a broader altcoin rally as money starts flowing into everything crypto.

But let's keep it real – crypto doesn't always go according to plan. If sentiment shifts or holders decide to lock in profits, ETH could easily slide back to $4,200 or even $4,000. That would put the bullish case on ice for a while and probably lead to some sideways action.

Peter Smith

Peter Smith

Peter Smith

Peter Smith