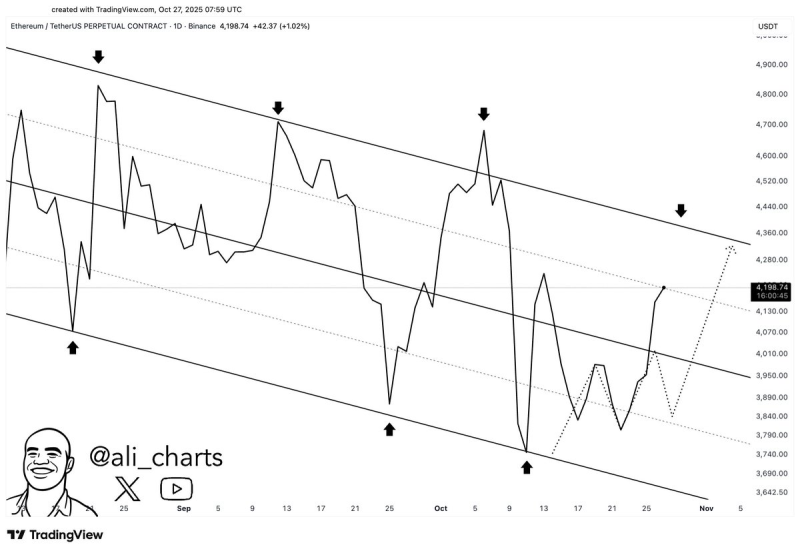

● Ali noted that Ethereum ($ETH) has recovered from the channel's lower boundary and is now moving toward the upper resistance line near $4,360. The 1-day TradingView chart shows Ethereum trading at $4,198, up 1.02%, reflecting a solid recovery from recent lows around $3,650. The pattern reveals a clear technical channel that's contained Ethereum's price since late August — each time it hits the lower boundary, a short-term rally toward the top follows.

● The key risk in this setup is a potential rejection at the channel's upper boundary. Ethereum has hit the $4,360 resistance multiple times, as shown by the arrows on the chart, and each time it's led to local pullbacks. Traders caution that without a clean breakout above this level, profit-taking could push ETH back toward support levels at $3,950–$3,800. A deeper drop might retest the lower channel near $3,650, though the overall uptrend stays intact as long as that support holds.

● From a financial perspective, breaking above $4,360 could shift short-term sentiment significantly. Such a move would likely draw in new buyers — both retail and institutional — potentially opening the door to $4,500 and $4,700 targets. On the flip side, a failed breakout could trigger more consolidation within the channel as investors rotate capital into altcoins or stablecoin yields while waiting for clearer direction.

● In the bigger picture, Ethereum's recovery is happening alongside renewed optimism across crypto. With Bitcoin holding above $115,000 and liquidity flows stabilizing, Ethereum's strength reflects growing confidence in Layer-2 scaling, DeFi activity, and the network's staking economy.

Peter Smith

Peter Smith

Peter Smith

Peter Smith