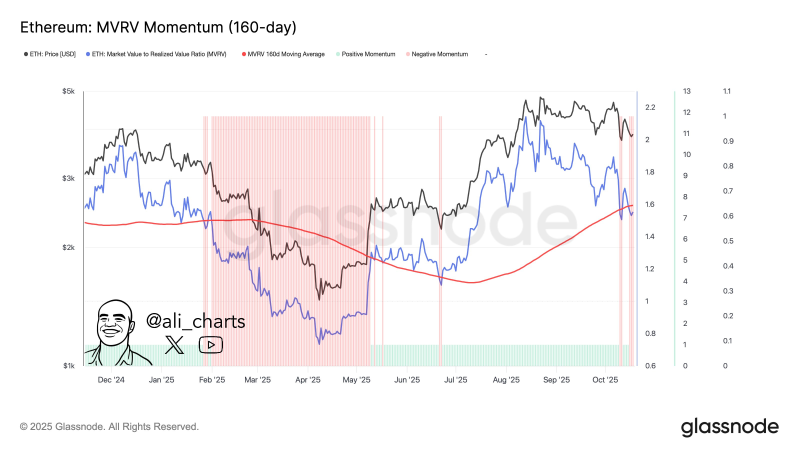

● Analyst Ali recently flagged that Ethereum may be heading into another bearish phase. The MVRV Momentum (160-day) indicator just flashed a death cross for the first time since the last major downturn—when ETH plunged from $3,300 to $1,400. This on-chain metric from Glassnode compares market value to realized value and has a solid track record of signaling shifts in investor profitability and price direction.

● The death cross happens when the MVRV ratio drops below its 160-day moving average, suggesting holders are becoming less profitable and selling pressure is building. Last time this occurred, Ethereum took one of its steepest hits of that cycle. With the signal flashing again, analysts are cautioning that ETH could see fresh downside, especially if market liquidity dries up or sentiment sours further.

● A prolonged bearish stretch could slow institutional money flowing into Ethereum funds, delay Layer-2 rollouts, and push capital toward Bitcoin or stablecoins instead. That said, some strategists think this might be a false alarm. Ethereum's fundamentals—DeFi activity, staking participation, network usage—still look strong. They're suggesting traders wait for confirmation before expecting another deep dive.

● The MVRV ratio has always been a useful tool for reading market psychology and network valuation. Death crosses typically mark the shift from optimism to caution, often followed by accumulation once the dust settles. If history repeats, Ethereum might wobble in the near term before finding its footing again.

Peter Smith

Peter Smith

Peter Smith

Peter Smith