While daily price action can create noise in the markets, Ethereum's recent performance demonstrates why traders often emphasize the importance of taking a longer-term view. Despite some short-term headwinds, ETH has delivered impressive gains over the past month.

Ethereum Price (ETH) Defies Daily Red With Monthly Strength

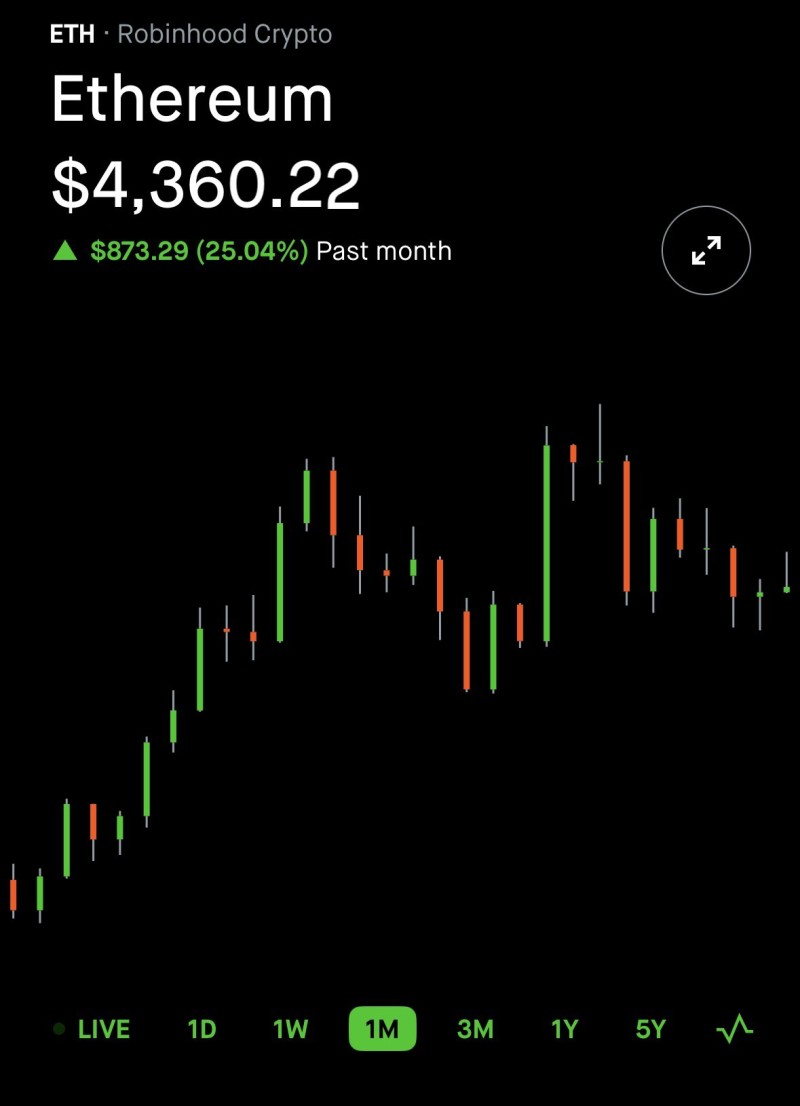

Ethereum's recent price action tells two different stories depending on your timeframe. Sure, today's candle might be red, but step back and you'll see ETH sitting pretty at $4,360.22 — that's a solid $873.29 jump from where it was just a month ago. We're talking about a hefty 25% gain that's hard to ignore.

Trader @bitcoinsnipa highlighted how the market's mixed feelings don't change the fact that Ethereum keeps pushing forward. It's a classic reminder that the big picture often matters more than what happens in a single day.

Market Sentiment Around ETH Price Is Divided

The Ethereum community is split right down the middle. Some traders are getting nervous about today's red candle, wondering if it's the start of something bigger. But the bulls aren't backing down — they're pointing to how ETH keeps finding higher lows, which usually signals underlying strength.

Technical analysts keep saying "look to the left," and for good reason. As Ethereum tests old resistance levels, there's a good chance these zones could flip into support, setting up the next leg higher.

Ethereum Price Outlook: Key Levels to Watch

The road ahead has some clear markers. Ethereum needs to break through $4,500 to really get things moving, with $5,000 looking like the next major target if momentum builds. On the downside, $4,000 is the line in the sand — lose that and those monthly gains could be in trouble.

The fundamentals still look solid though. Between DeFi growth and institutional money flowing in, there's plenty of fuel for Ethereum's continued climb through the rest of the year.

Usman Salis

Usman Salis

Usman Salis

Usman Salis