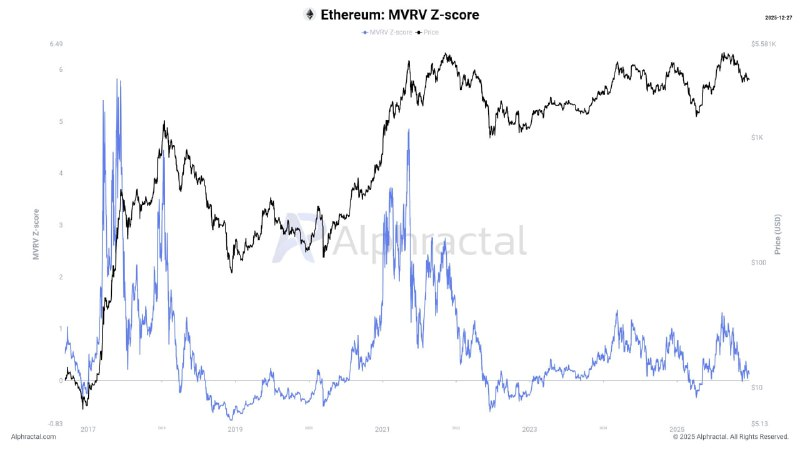

⬤ Ethereum's walking a tightrope right now. Three critical on-chain metrics—MVRV Z-Score, Market Cap Growth, and Delta Growth—are all flashing yellow. If these indicators keep sliding, we could see speculative money heading for the exits, potentially pushing ETH under that psychological $2,000 mark as we roll into 2025.

⬤ The MVRV Z-Score (which basically tells us if ETH's overpriced compared to its actual network value) isn't looking great. When this metric drops, it's saying the market's paying too much for what they're getting. Throw in sluggish market cap growth and declining Delta Growth, and you've got a recipe for downward pressure. With supply climbing and demand cooling off, the setup's getting shakier.

⬤ ETH's been bouncing around the $1,700-$1,800 zone lately, and honestly, if these on-chain signals don't turn around, breaking below $2K becomes a real possibility. The combo of more coins hitting the market while fewer people want them? That's not exactly bullish. Unless we see these metrics stabilize soon, Ethereum might be in for a rough ride.

Usman Salis

Usman Salis

Usman Salis

Usman Salis