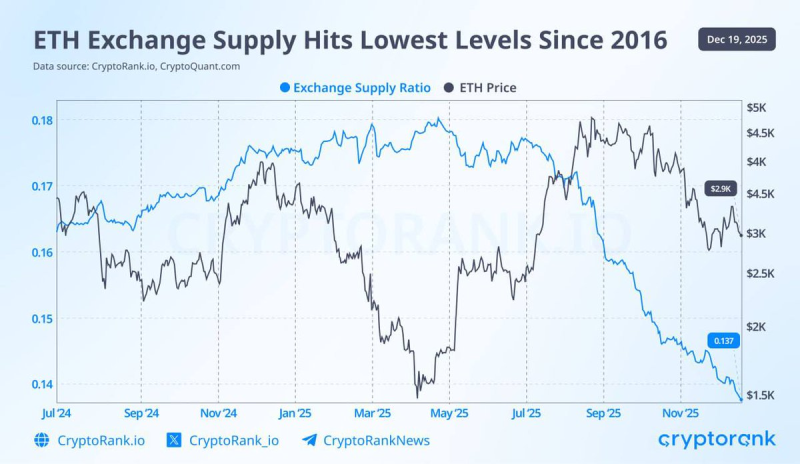

⬤ Ethereum just hit a major milestone that hasn't been seen in nearly a decade. The amount of ETH sitting on centralized exchanges has dropped to its lowest level since 2016, marking a dramatic shift in how investors are holding their tokens. Throughout 2024 and 2025, we've watched this trend play out consistently, with fewer and fewer ETH tokens being parked on exchanges where they'd be ready to sell.

⬤ The numbers tell the story clearly. By mid-December 2025, Ethereum's exchange supply ratio had fallen to approximately 0.137, down significantly from the 0.18 level seen earlier in the period. During this same time, ETH price has been dancing around, showing plenty of volatility and recently trading near $2,900. Data from CryptoRank and CryptoQuant confirms this isn't just a temporary blip.

This shift reflects fewer ETH tokens being positioned on exchanges, signaling a structural change in supply dynamics rather than a short-term trading anomaly.

⬤ Here's what makes this interesting: while Ethereum's price has been moving up and down pretty dramatically, the exchange supply trend just keeps heading lower without reversing course. That tells us people are steadily moving their ETH off exchanges regardless of what price is doing. When fewer tokens are sitting on exchanges, there's naturally less immediate selling pressure since the coins aren't as readily available for quick liquidation.

⬤ This matters because exchange supply levels directly affect market liquidity and how easy it is for sellers to dump their holdings. A sustained drop in ETH on exchanges could influence how price reacts to demand changes or market stress. While low exchange balances don't guarantee price will go up, this structural trend could provide support for Ethereum's market outlook going forward.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah