Ethereum (ETH) could decline further as Middle East war tensions escalate, with the price already trading below key support levels.

Ethereum Slips Below $2,595 Support Level

Ethereum (ETH) is trading below its crucial support level of $2,595, as heightened geopolitical tensions in the Middle East send waves of uncertainty through global markets. On Tuesday, ETH saw a dip, reflecting the broader downtrend in the crypto market as investors brace for potential escalations in the conflict. The price drop follows Iran’s missile attack on Israel, which shook investor confidence and contributed to ETH falling below the $3,500 psychological barrier.

Market participants are now closely watching to see if further conflict will push Ethereum's price even lower, with $2,207 emerging as a possible bottom if tensions continue to escalate.

Ethereum Exchange Reserves and ETF Outflows Indicate Selling Pressure

The latest data from CryptoQuant reveals that Ethereum exchange reserves have increased by over 144K ETH within the last 24 hours. This rise in exchange reserves suggests investors are moving toward a more cautious approach, possibly positioning for further sell-offs as the global situation remains tense. An increase in spot exchange reserves typically signals higher selling pressure, raising concerns about continued price declines for Ethereum.

In addition, Ethereum ETFs have seen significant outflows, with Monday’s data showing a net outflow of $0.8 million. Despite BlackRock’s ETHA ETF receiving an inflow of $11 million, Grayscale's ETHE ETF saw $11.8 million in outflows, contributing to the overall negative trend in Ethereum’s ETF performance. In contrast, Bitcoin ETFs posted a net inflow of $61.3 million, indicating a stark difference in market sentiment between the two top cryptocurrencies.

Ethereum’s Performance Lags Behind Bitcoin ETFs

Since their introduction, Ethereum ETFs have struggled to match the success of Bitcoin ETFs. A key executive from asset management giant BlackRock has weighed in, stating that the underperformance of ETH ETFs is likely to continue. According to a report from Fortune, the executive noted that Ethereum's investment narrative is more complex for traditional investors, making it harder to gain widespread adoption.

The BlackRock executive emphasized that issuers must make concerted efforts to educate and inform potential investors about Ethereum’s unique use cases, such as decentralized applications and smart contracts, to bridge the knowledge gap in the market.

Ethereum Breaks Key Support Levels and Faces Further Declines

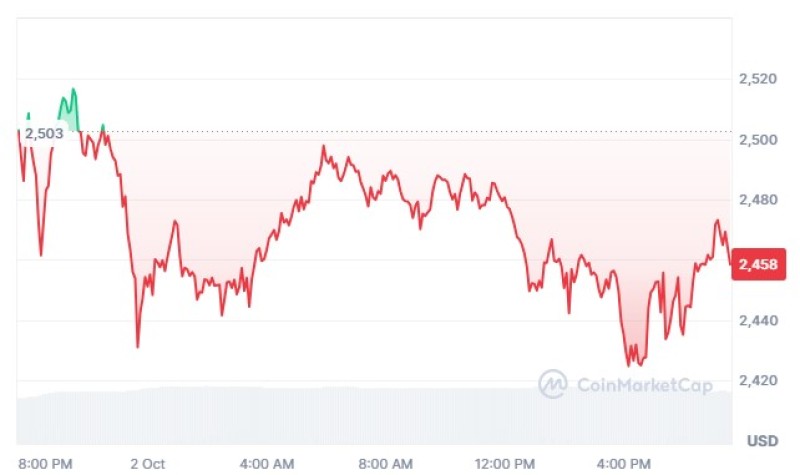

On Tuesday, Ethereum was trading at approximately $2,480, marking a nearly 4% decline. Over the past 24 hours, ETH has endured liquidations totaling over $87 million, with long and short positions accounting for $71.01 million and $16.36 million, respectively. This is Ethereum’s highest liquidation volume since August, signaling increased volatility in the market.

The drop below $2,595 also saw Ethereum slip under its 50-day, 100-day, and 200-day Simple Moving Averages (SMAs), all pointing to a growing bearish outlook. The next key level to watch is $2,395, and should this level be breached, Ethereum could be on track to test the $2,207 support level.

Bearish Indicators and Outlook for Ethereum

Technical indicators also suggest further downside risks for Ethereum. The Relative Strength Index (RSI) and the Stochastic Oscillator (Stoch) are trending below their neutral levels and nearing oversold regions, reinforcing the possibility of continued price declines.

However, a rebound above the $2,595 support level could reverse the bearish outlook, potentially restoring investor confidence. Traders are now watching for any developments in the Middle East conflict, as further escalations could lead to even more market volatility.

Conclusion

The ongoing geopolitical tensions in the Middle East are causing significant uncertainty for Ethereum investors. With exchange reserves rising and ETF outflows mounting, the price of ETH could continue its downward trajectory if the situation worsens. Key technical indicators suggest a bearish outlook, but a recovery to $2,595 could invalidate this trend. Investors are urged to remain vigilant as the situation develops, with Ethereum’s next moves highly dependent on global events.

Peter Smith

Peter Smith

Peter Smith

Peter Smith