Ethereum recently saw one of its biggest short-term supply movements in months, with 230,000 ETH pulled from exchanges within two days. This substantial outflow suggests investors are holding rather than selling, which could set the stage for the next significant price shift.

Major Exchange Withdrawals Signal Confidence

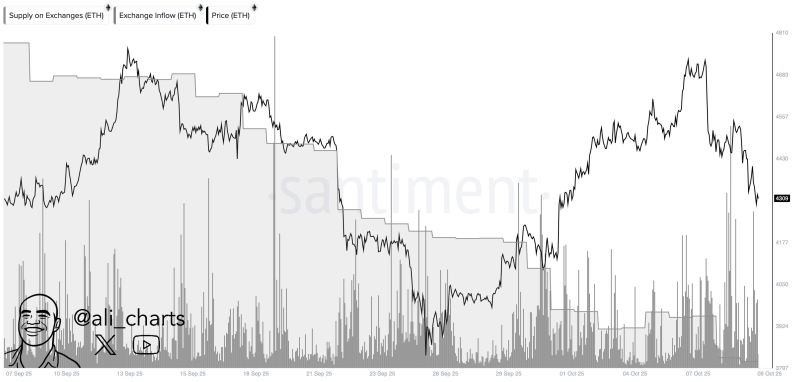

Crypto analyst Ali highlighted this trend, showing exchange supply dropping sharply while inflow spikes couldn't match the withdrawal volume. When traders move coins off exchanges into cold storage or staking, it typically means less selling pressure and more confidence in future gains. The data backs this up: exchange reserves fell noticeably while prices stayed relatively stable between $4,300 and $4,600, despite some volatility.

Price action has been choppy lately, with ETH touching above $4,600 before pulling back toward $4,300, but the key takeaway is that support levels have held better than in late September. When exchange supply drops but prices don't collapse, it often points to quiet accumulation happening behind the scenes. Less ETH sitting on exchanges ready to be sold means potential for a supply crunch if demand picks up, especially with the $4,600–$4,700 zone acting as the main resistance to watch.

What's Next for ETH

The outlook looks cautiously optimistic. Ethereum's fundamentals haven't changed, and this withdrawal pattern shows investors betting on the long game. If this accumulation phase continues and buying interest remains steady, ETH might be gearing up to challenge its recent highs again, possibly breaking through in the coming weeks. That said, the market's still volatile, so keeping an eye on exchange inflows matters since a sudden reversal could signal profit-taking or renewed selling pressure.

Usman Salis

Usman Salis

Usman Salis

Usman Salis