Ethereum (ETH) Foundation clears up wallet confusion while ETH surges 30% weekly, trading just 2.35% below all-time highs.

ETH Foundation Says "Not Us" to $12.8M Wallet Drama

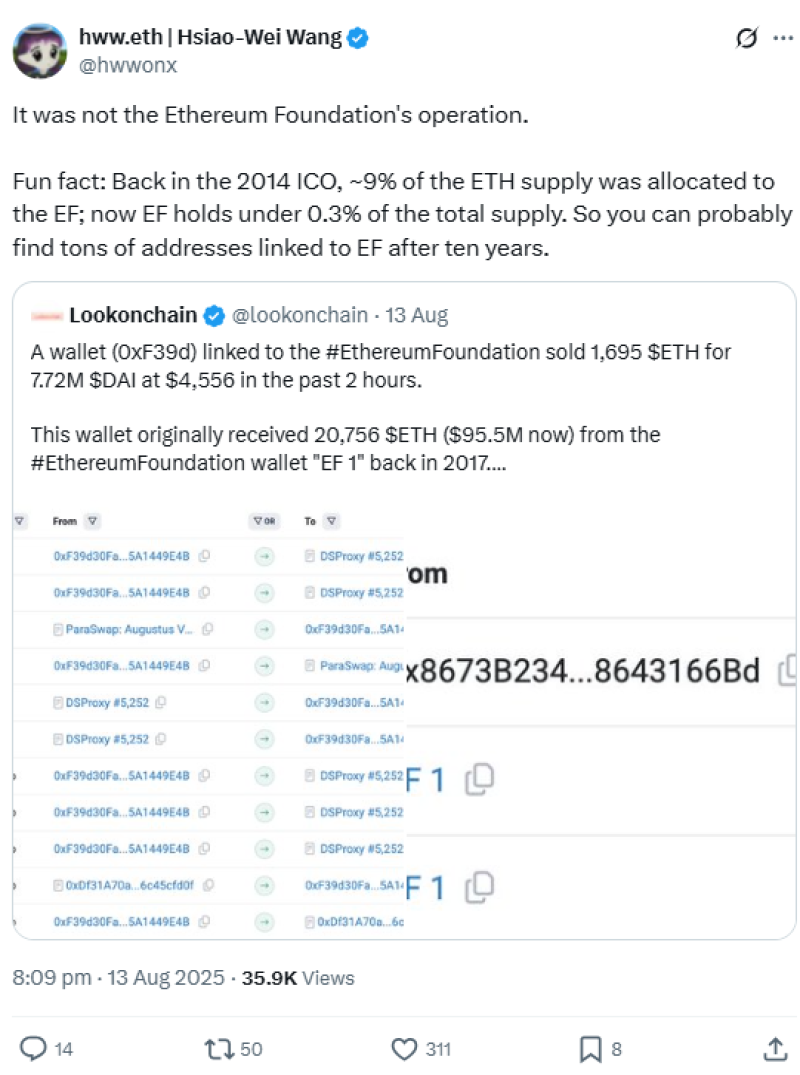

The crypto community freaked out over a $12.8 million ETH sell-off, but it was all for nothing. Ethereum Foundation co-Executive Director Hsiao-Wei Wang jumped on X to set things straight: "It was not the Ethereum Foundation's operation."

The drama started when on-chain trackers spotted someone dumping 2,975 ETH from what looked like a Foundation wallet. The address had received ETH from a Foundation-linked wallet back in 2017, making everyone think it was connected to old ICO allocations.

Wang explained that tons of wallets from that era are still out there, but the Foundation doesn't control them anymore. Back in 2014, they held 9% of all ETH. Now? Less than 0.3% of the total supply.

Ethereum (ETH) Foundation's Strategic Downsizing Continues

The Foundation has been deliberately shrinking their holdings to reduce network influence. Their biggest recent move was selling 10,000 ETH directly to SharpLink Gaming in July - making the company the second-largest corporate ETH holder.

While the Foundation scales back, corporate treasuries have gone wild for ETH, accumulating over $14 billion worth in just months. Perfect timing for the Foundation's exit strategy.

ETH Price Soars Despite Corporate Concerns

Vitalik Buterin isn't thrilled about corporate hoarding, calling it a "double-edged sword." His worry? Companies might borrow against their ETH and face forced liquidations during downturns, creating market chaos.

But the market doesn't care about warnings right now. ETH is crushing it at $4,704 - up 30% this week and just 2.35% from its all-time high. Corporate concentration or not, ETH holders are definitely not complaining.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah