Ethereum (ETH) just smashed through $4,000 for the first time since December. Now everyone's asking: is this the start of a rally to $7,000, or are we about to see a brutal correction?

ETH Bulls Take Control After Major Breakout

Ethereum broke out of a multi-year megaphone pattern last week, sending prices rocketing to a weekly high of $4,329. Right now, ETH is at $4,303, up 19% in seven days with 190% gains year-to-date.

The breakout was decisive. ETH is trading above all major moving averages, the 50-day MA is above the 200-day MA, and the MACD is flashing green. All technical indicators are aligned for more upside.

If this momentum continues, analysts are eyeing $7,000 - that's 62% from here. The chart pattern supports it, and we're just 12% away from all-time highs.

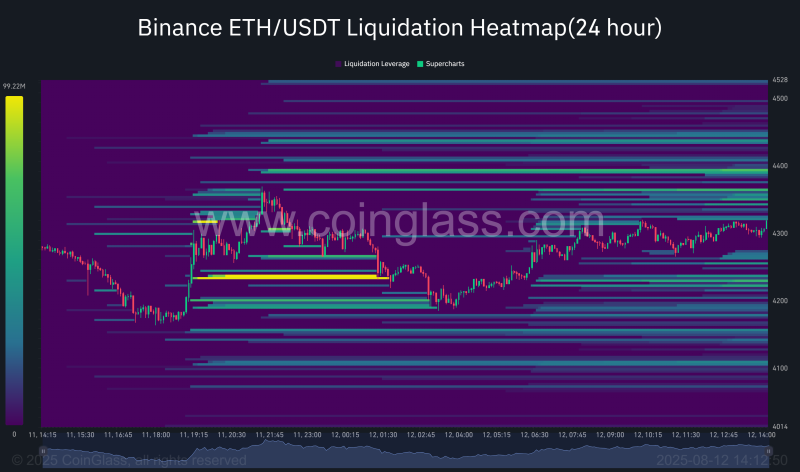

Ethereum (ETH) Faces Key Liquidation Zones

CoinGlass data shows massive liquidation clusters between $4,200-$4,300, with more around $4,400-$4,500. These levels act like price magnets.

If things go south, there's support around $4,100-$4,150. A break below could trigger cascading liquidations.

Record ETF Inflows Signal Institutional Interest

Yesterday was huge - Ethereum ETFs pulled in $1 billion in net inflows, the biggest single-day haul since launch. After two quiet weeks, institutions are finally waking up to ETH.

But Glassnode data shows short-term holders are taking profits more aggressively than long-term investors. Classic sign some traders expect a pullback.

This week's economic data could tip the scales. CPI Tuesday, PPI Thursday, retail sales Friday. If inflation keeps cooling and the Fed cuts rates sooner, that's rocket fuel for crypto.

Bitcoin's weekend rally to $122k left a CME gap around $117,200. These gaps usually get filled, and if BTC pulls back, it'll drag ETH down too.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah