Ethereum is catching traders' attention as technical indicators point to a significant upward move. The cryptocurrency is approaching a crucial resistance at $4,811, historically an important pivot point. Breaking through this barrier could drive prices toward the $8,500 target that analysts are eyeing.

Technical Setup

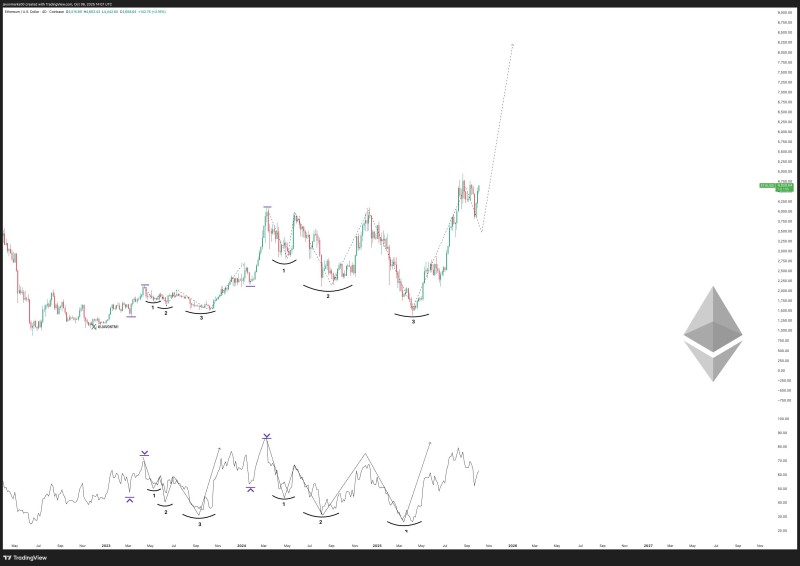

Recent market commentary, including insights from trader Javon MARKS, suggests that Ethereum appears ready to enter another bullish phase. The current chart reveals encouraging patterns. Ethereum has formed multiple rounded accumulation zones, each followed by sharp upward moves, showing buyers steadily building positions before pushing prices higher. The market structure displays consistent higher lows, confirming buying pressure remains intact.

The critical near-term obstacle sits at $4,811.71. A decisive break above this level would likely trigger accelerated buying. Based on the technical structure, Ethereum could first target $6,500 before pushing toward $8,500 or higher, following the bullish wave pattern in longer-term charts.

Supporting Fundamentals

Several developments strengthen Ethereum's outlook. Institutional adoption continues expanding in DeFi and real-world asset tokenization. On-chain metrics show climbing staking activity and robust Layer-2 performance. Growing speculation around a potential U.S.-listed Ethereum ETF has boosted sentiment, while capital rotation from Bitcoin into major altcoins creates favorable conditions for ETH.

The focus remains on breaking through $4,811 resistance. A strong move above this level would likely trigger rapid gains toward $6,500, with $8,500 becoming the next realistic target. However, failure to clear this zone could send prices back toward $3,800-$4,000 support, delaying but not necessarily invalidating the bullish outlook.

Usman Salis

Usman Salis

Usman Salis

Usman Salis