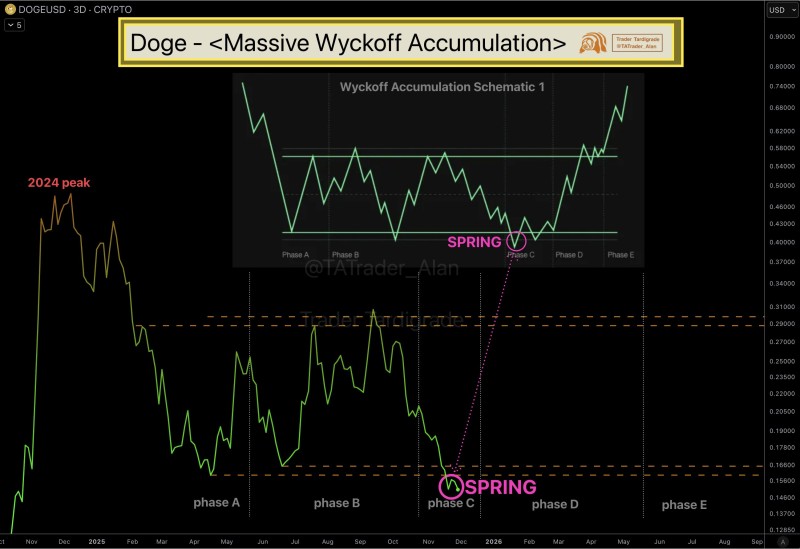

⬤ Dogecoin has hit the Spring stage of Wyckoff Accumulation on the 3-day chart, based on fresh market structure analysis. Right now, DOGE sits in Phase C—the part of the Wyckoff cycle where price makes one last sweep below support to flush out weak holders before setting up for a possible recovery. The comparison chart lines up Dogecoin's recent moves with the classic Wyckoff Accumulation Schematic 1, and the match is striking.

⬤ The multi-month range breaks down into Phases A through E, tracking how Wyckoff accumulation typically unfolds. Phase A captured the initial drop and stabilization after DOGE peaked in 2024. Phase B brought extended sideways action through mid-2025, with price testing the middle of the range repeatedly while building a wide base. The shift into Phase C shows up as a sharp dip toward the $0.15-$0.17 support zone—this is the Spring. It's essentially a final shakeout meant to absorb leftover supply and create the foundation for what comes next.

⬤ Spotting a clear Spring matters in Wyckoff terms because it usually marks the bottom of the accumulation phase. The schematic shows that after Phase C wraps up, assets tend to move into Phase D, where buyers start stepping in more aggressively and price begins forming higher lows. Dogecoin's chart suggests it might be sitting right at this transition point, with the actual price action mirroring the theoretical pattern almost perfectly.

⬤ This matters because recognizable Wyckoff structures give traders a framework for reading medium-term momentum. A well-formed Phase C often signals that selling has likely run its course, putting focus on whether DOGE can hold above the Spring low and start pushing into the higher ranges tied to Phase D. As long as the structure stays intact, the Wyckoff model offers a way to gauge how Dogecoin responds to incoming demand and whether a new accumulation expansion phase is taking shape.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah