Dogecoin is showing signs of life after retesting an important support level. For a meme coin that still commands massive retail attention, this could be significant.

Chart Analysis: Flipping Resistance to Support

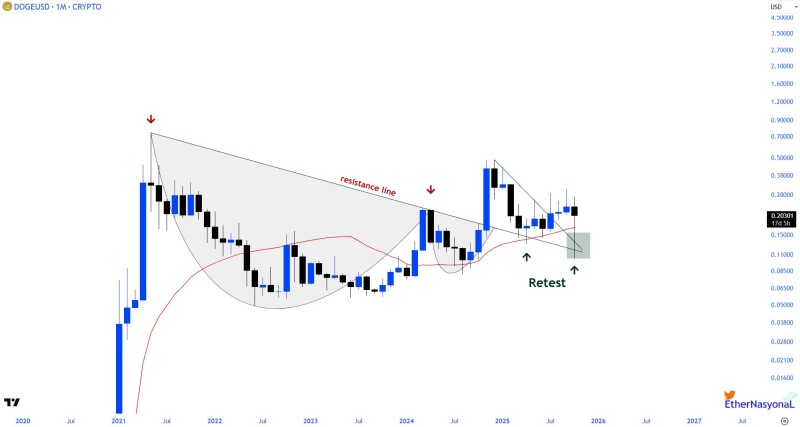

Analyst EtherNasyonaL recently highlighted this structural retest, pointing out how the price action suggests a long-term bullish setup. The monthly DOGE/USD chart tells an interesting story. After years of being stuck under a descending resistance line dating back to the 2021 peak, Dogecoin finally broke through. The price formed a broad rounding bottom—a classic accumulation pattern that often leads to sustained rallies.

What's particularly encouraging is what happened next. After breaking out, DOGE pulled back to the $0.15–$0.16 zone and tested it as support. Buyers stepped in aggressively, defending that level and confirming it as a new floor. Now trading around $0.20–$0.21, DOGE is consolidating above this support. If it holds here, we could see another leg up.

What's Driving This?

A few things are working in Dogecoin's favor right now. The broader crypto market has stabilized, with Bitcoin's strength typically lifting major altcoins. On-chain activity has picked up too, with developers exploring tokenization and NFTs on the Dogecoin network. And of course, retail traders haven't lost interest—DOGE still moves on sentiment and social media hype.

Key Levels to Watch

- Support: The $0.15–$0.16 area needs to hold

- Resistance: Next major barrier sits at $0.28–$0.30, where previous rallies stalled

- Long-term target: If momentum really builds, $0.50+ is possible, though that would need strong market-wide conditions

Dogecoin's monthly chart suggests it's shifted from a long downtrend into something more constructive. The breakout and successful retest strengthen the bullish argument. If current levels hold, DOGE might be setting up for a significant move higher in the coming months. Whether that happens depends on both Bitcoin's direction and whether retail enthusiasm returns in force.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah