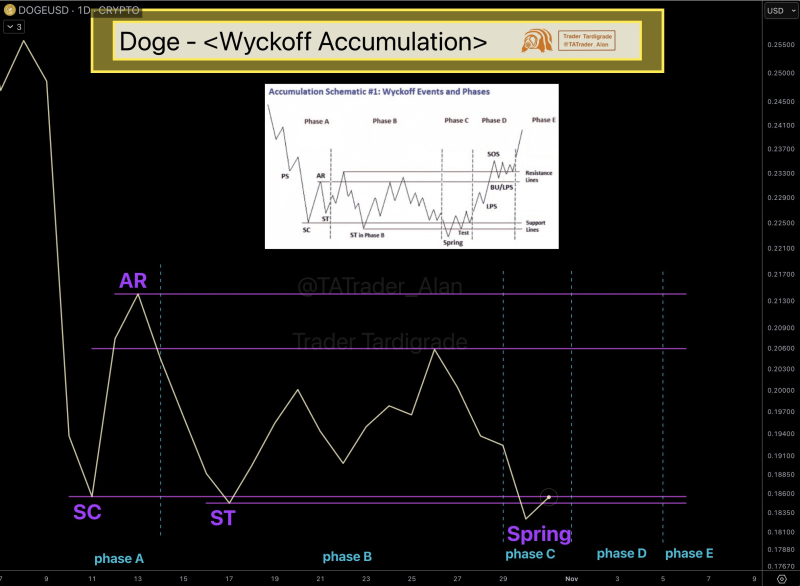

● Crypto analyst Trader Tardigrade recently pointed out that Dogecoin appears to be wrapping up a Wyckoff Accumulation pattern—a technical formation that typically marks the shift from bearish consolidation to bullish momentum. "Major events of the Wyckoff Accumulation were observed in the recent Dogecoin daily line chart. Let's see if the spring price action unfolds," the analyst noted.

● The Wyckoff model, created by legendary trader Richard Wyckoff, maps out how smart money accumulates assets before a breakout. DOGE has moved through Phase A (Selling Climax and Rally) and Phase B (Secondary Tests), and is now entering Phase C—the "Spring." This is where the price briefly dips below support to shake out weak hands before bouncing back up.

● The key risk here is whether the spring holds. If DOGE fails to rebound, it could face more sideways action or even drop further. But if it stays above the $0.18 support zone and pushes into Phase D, we could be looking at the start of a serious rally.

● For traders, a confirmed spring typically brings renewed buying interest, higher volume, and meaningful price gains. If this plays out, it could jumpstart Dogecoin's momentum after weeks of drifting and lift sentiment across the altcoin market.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah