Dogecoin never does things halfway. After a sharp rally followed by an equally brutal reversal, the latest price action serves as a stark reminder that even experienced traders can get caught off guard. One trader's recent experience offers valuable insights into both the technical challenges facing DOGE and the psychological discipline required to survive in crypto markets.

A Trader's Honest Confession

Crypto trader Mercury recently shared a brutally honest breakdown of his Dogecoin spot trade that went sideways. Despite banking nearly 9R in profits for the month from successful BNB and PUMP longs, a single DOGE position wiped out everything he'd gained.

His approach seemed sound at first. He had strong conviction in the setup and intentionally held through a 50% rally without taking profits, betting on further upside. When the trade reversed, his stop-loss got hit with about 7% slippage on top of the loss. The result? A month's work erased in one move. Still, Mercury noted that compared to his earlier trading days, when this kind of volatility could have meant total liquidation, walking away with lessons learned rather than a blown account showed real progress in his risk management.

What the Chart Tells Us

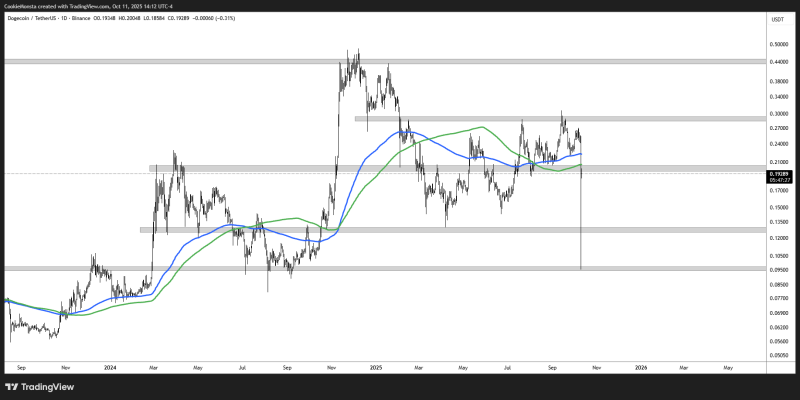

Looking at the DOGE/USDT daily chart, the technical picture backs up what happened:

- Support around $0.19: Dogecoin is currently trading near this level, which has flipped between support and resistance multiple times throughout 2025

- Resistance zone at $0.27–$0.30: Every attempt to push higher has been rejected here, triggering the sharp pullback we're seeing now

- Moving average squeeze: The 50-day and 200-day moving averages are converging, showing the market is stuck in limbo between bullish and bearish momentum

- Wild volatility: Earlier pumps in 2025 prove DOGE can still deliver explosive moves, but they also highlight how quickly those gains can evaporate

The chart essentially mirrors the trader's experience: a setup that looked promising got crushed when the breakout failed and price collapsed back into range.

Dogecoin is trapped in a choppy sideways pattern. Bulls need a decisive breakout above $0.27–$0.30 to get things moving again. If support at $0.19 fails, we could see DOGE slide toward $0.13–$0.15. For active traders, this reinforces that position sizing and stop-loss discipline matter just as much as finding the right entry. For long-term holders, it's another reminder that Dogecoin runs on speculation and sentiment more than fundamentals.

Peter Smith

Peter Smith

Peter Smith

Peter Smith