The SEC just made it way easier for crypto ETFs to get approved with new rules focused on futures markets. About a dozen altcoins could soon get their own ETFs, potentially boosting crypto ETF price action.

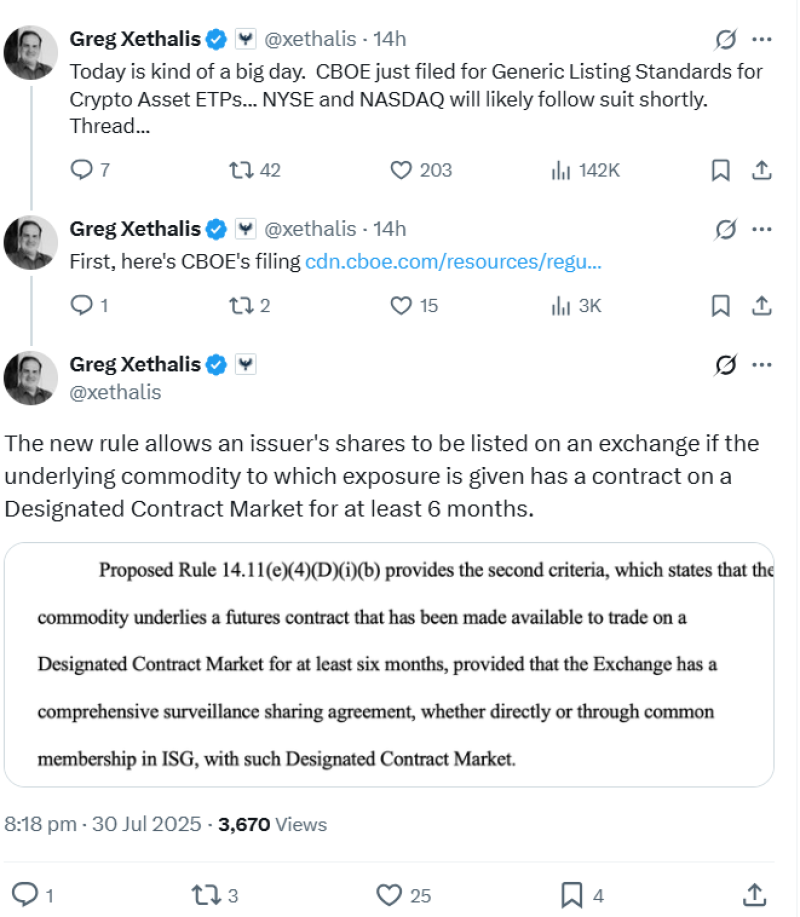

New Rules Make Crypto ETF Approvals Much Simpler

The SEC's new listing standards are straightforward - if a cryptocurrency has futures contracts listed for at least six months on either Coinbase Derivatives or the Chicago Mercantile Exchange (CME), it can qualify for an ETF.

Bloomberg ETF analyst Eric Balchunas called this a "pretty big deal," saying it opens the door for roughly a dozen altcoins to get ETFs. "Any coin that has futures tracking it for over six months on Coinbase's derivatives exchange would be approved".

Coinbase's derivatives marketplace has way more coins than the CME, making it the easier path. This comes right after the SEC approved in-kind redemptions for Bitcoin and Ethereum ETFs.

Some Crypto ETF Assets Left Behind Despite New Framework

The SEC is using futures markets as a quality filter, but not every crypto makes the cut. ETF analyst James Seyffart points out that the SEC is outsourcing its decision-making - it's all about futures markets now.

"The SEC pseudo outsourced the decision making for which digital assets will be allowed in an ETF wrapper. The CFTC is the primary decider of what asset can have futures contracts," he explained.

Meme coins like Bonk or Trump coin don't have active futures markets, so they'd need a much more complex approval route.

Crypto ETF Price Action Timeline Points to Fall Launch

Balchunas thinks approvals could come as soon as September or October. Coinbase Derivatives stays in a powerful position as the main gateway for new crypto ETFs.

This rule change is a huge milestone for crypto's move into mainstream finance, giving us a clear roadmap for how more assets beyond Bitcoin and Ethereum could get ETF exposure soon.

Peter Smith

Peter Smith

Peter Smith

Peter Smith