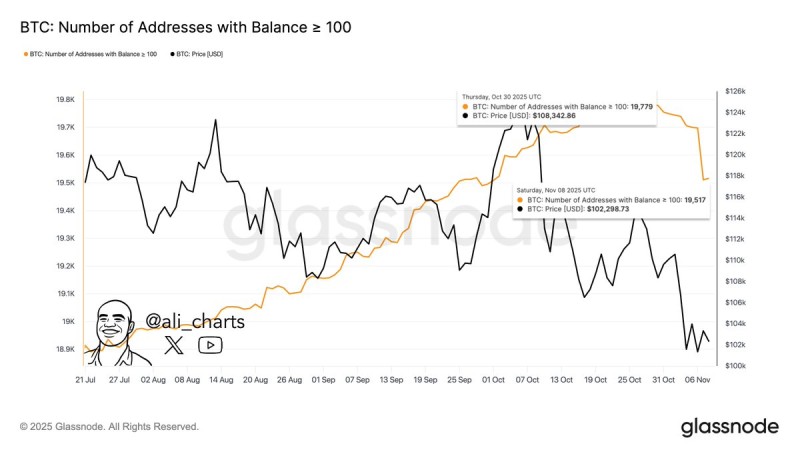

⬤ The number of Bitcoin wallets holding over 100 BTC fell fast over the past week—from 19,517 down to 18,779. That's a significant drop at the upper end of the market, where the so-called "whales" operate.

⬤ The Glassnode chart tells the story clearly: whale balances peaked at 19,779 on October 30, then slid steadily into early November. During that same stretch, Bitcoin's price fell from above $108,000 to around $102,000—a notable pullback as big holders started unloading coins.

⬤ This shift suggests whales are locking in profits after Bitcoin's recent rally, which has added some short-term selling pressure. When high-balance wallets start declining, it usually means the biggest players are getting cautious—especially when prices begin weakening from previous peaks.

⬤ For traders and investors, this drop in whale holdings is worth watching. If it continues, it could weigh on sentiment and slow any near-term recovery. But if whale addresses stabilize, that might signal distribution is easing and the market is finding its footing after the correction.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah