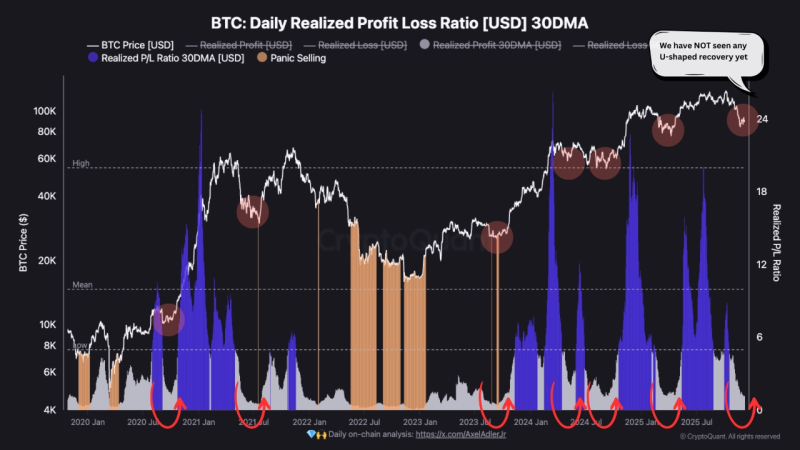

⬤ Bitcoin keeps trading sideways. On-chain data shows no sign of a U-shaped recovery. The 30-day realized profit-to-loss ratio stays low, which indicates that BTC is still forming a base instead of launching a strong rebound. A clear upward bend in the 30-day moving average of this ratio would act as the main trigger for recovery - that bend has not appeared.

⬤ Historical records show that Bitcoin tends to post sharp realized profit/loss spikes at market peaks and deep resets at cycle lows. Current values sit close to past low zones - yet they lack the panic driven selloff that marked multiple earlier bottoms. BTC trades in a narrow range with low volatility. Long-term holders appear steady because realized losses show no sudden jumps.

⬤ Earlier cycles show that long stretches of low realized profit/loss ratios often preceded large directional moves once momentum returned. Recent data do not resemble the strong U-shaped rebounds that preceded past bull runs. The realized profit/loss bands stay tight and the 30-day moving average has yet to curve upward. This supports the view that BTC remains in an accumulation phase plus that the market is quietly building a structural bottom.

⬤ Bitcoin's realized profit/loss metrics serve as a network wide sentiment gauge. When readings stay low and no capitulation occurs, the market waits instead of reacts, a setup that often leads to sharp volatility once a clear direction emerges. A confirmed turn higher in the 30-day moving average would signal improving momentum and could mark the start of a new trend. Until that signal arrives, BTC's backdrop remains one of consolidation, stability but also preparation rather than recovery.

Peter Smith

Peter Smith

Peter Smith

Peter Smith