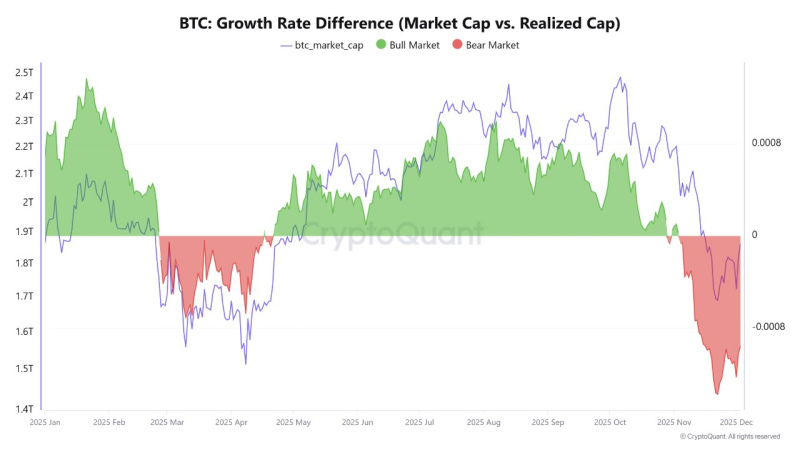

⬤ Bitcoin now stands at a decisive moment as it fights to rise above the $100,000 level. New data from the blockchain shows that the total market value of all coins in circulation is falling more quickly than the value calculated from coins last moved at lower prices. This pattern signals that demand is weakening. The figures show that the strong upward trend seen earlier in 2025 has turned into contraction as the year nears its close.

⬤ During most of mid-2025, Bitcoin maintained a clear lead of market value growth over realized value growth and kept a total valuation above two trillion dollars. In November the picture reversed - market value started to shrink faster than realized value. That sequence matches textbook definitions of a bear phase and it unfolds just as the price tries to break the symbolic $100,000 barrier.

⬤ The data outline two outcomes. Price either powers through $100,000 plus extends the uptrend or it faces rejection and retreats toward support between $90,000 and $87,000. Past episodes show that such negative differentials tend to bring downward pressure. By early December the market value trend had already edged toward recent lows revealing a tug-of-war between buyers who want higher levels but also sellers who lock in profits.

⬤ The distance between market value and realized value serves as a live health check for the market. When market value drops faster, holders are converting to cash, confidence is eroding or fresh capital is no longer entering at the prior pace. Whether Bitcoin reverses this momentum or continues to decline will shape sentiment across crypto markets during the final weeks of 2025.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah