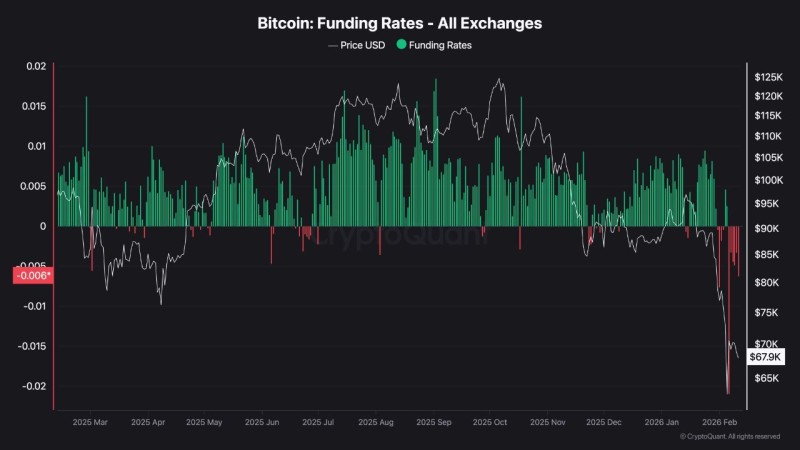

⬤ Bitcoin derivatives markets are flashing a bearish signal even as the price stabilizes. Funding rates recently dipped to around -0.006 while BTC traded near $68K, meaning short sellers are actually paying long holders to keep their positions open. That's a pretty clear sign that traders are betting on more downside, even after the recent bounce from lower levels.

⬤ The price action tells an interesting story. BTC slid down toward the $60,000 zone before climbing back up to roughly $68,000, but funding stayed negative the whole time. When funding goes below zero, it usually means the perpetual futures market is packed with shorts—traders are willing to pay a premium just to maintain their bearish bets. As CryptosRus noted in their original analysis, this kind of positioning shows how defensive the market remains despite the recovery in price.

Funding printed around -0.006, meaning short sellers are paying long holders even as Bitcoin holds near $68K

⬤ This situation fits into a broader narrative about leverage getting flushed out of the system. When volatility spikes and liquidations pile up, positioning often stays cautious even after the initial crash. TheTradable's coverage of funding rate and basis rate signals provides more context on how these derivatives metrics can reveal market sentiment. The platform also recently highlighted a major deleveraging phase in Bitcoin open interest drawdowns, showing how reduced leverage typically follows sharp moves and heavy liquidation pressure.

⬤ What stands out here is the disconnect: price is rebounding, but sentiment is still firmly bearish based on funding. That gap suggests traders aren't convinced the rally has legs. TheTradable has also documented how large liquidation events can reshape positioning and short-term market behavior, a pattern that often shows up when derivatives markets are under stress. For now, the negative funding tells us one thing clearly—shorts are in control, at least in the futures market.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi