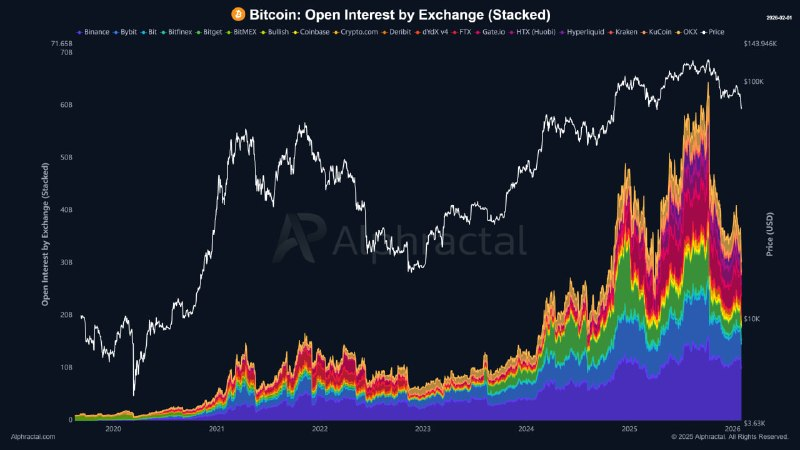

⬤ Bitcoin just experienced what looks like its biggest deleveraging event ever. Total derivatives open interest dropped about 50% from the October all-time high in just four months. The chart tracking stacked open interest across major exchanges shows a broad, synchronized decline in leveraged exposure. The magnitude and speed of this contraction make it historically significant compared to previous market cycles.

⬤ What stands out is that the decline happened across nearly all major trading venues, not just one exchange. This points to a market-wide reduction in leverage rather than isolated problems on specific platforms. Historically, periods with elevated open interest have coincided with increased volatility and vulnerability to liquidation cascades. The recent drawdown shows that a huge chunk of overleveraged positions got unwound as price momentum cooled and funding conditions shifted.

⬤ What's interesting is that Bitcoin's price has stayed relatively stable despite the sharp drop in open interest. While price has pulled back from recent highs, the decline has been far less dramatic than the leverage reduction shown in the chart. This divergence suggests a shift in market structure, with spot market activity playing a bigger role compared to highly leveraged derivatives trading. The chart also shows how open interest expanded rapidly during the 2024–2025 rally before peaking, confirming that leverage had built up significantly before this reset.

⬤ This matters for the broader market because large deleveraging events often change trading dynamics and risk profiles. A lower-leverage environment can reduce the frequency of forced liquidations and support more stable price discovery. With a significant amount of speculative excess already cleared out, future Bitcoin price movements may be driven more by underlying demand and macro conditions than by aggressive leverage. How and when open interest starts to rebuild will be closely watched as a signal of renewed risk appetite and the strength of any future market advance.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah