Bitcoin's funding rate and three-month annualized basis rate suggest potential upward movement in its price.

Bitcoin Funding Rate Analysis

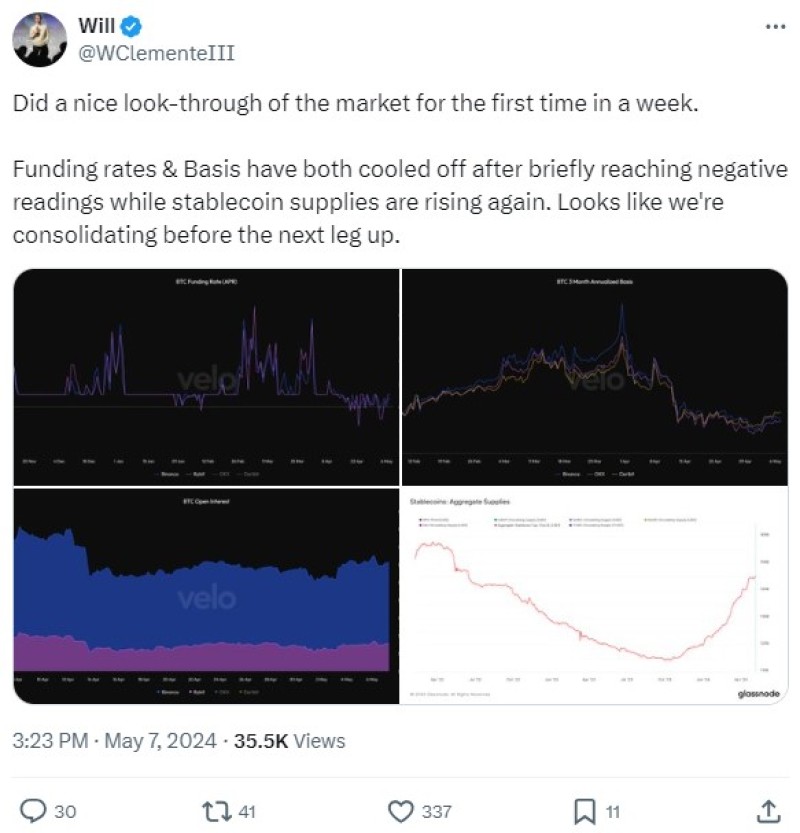

Bitcoin's funding rate and three-month annualized basis rate have caught the attention of traders, indicating a possible bullish trend ahead. Reflexivity Research co-founder, Will Clemente, noted that Bitcoin's funding and basis rates have "cooled off" after briefly dipping to negative readings, hinting at a consolidation phase before an upward surge.

The funding rate, a key indicator in Bitcoin trading, reflects trader sentiment and market dynamics. Positive funding rates signify increased confidence among long-position traders regarding Bitcoin's price rise. Despite recent fluctuations, the open interest-weighted funding rate stands at 0.0091%, recovering from a dip to -0.0050% on May 4, as reported by CoinGlass data.

Market Sentiment and Price Action

Pseudonymous commentators in the crypto space, such as Crypto Empire and Mister Crypto, echo optimism regarding Bitcoin's low funding rates amidst price rebounds. The recent 1.11% price increase to $62,361 aligns with this sentiment, although liquidation data indicates a lingering bearish sentiment among futures traders, anticipating a potential price drop.

Analysis reveals that a 3.5% price rise to $65,000 could trigger liquidation of $1.36 billion in short positions, while a drop to $60,500 would wipe out $650 million in long positions. This dichotomy underscores the volatility and divergent expectations within the market.

Annualized Basis Rate Assessment

Additionally, Bitcoin's annualized basis rate, observed across major exchanges like Binance, OKX, and Deribit, has surged towards the higher end of the 5–10% neutral range. This metric, comparing Bitcoin futures contract costs to the actual asset price, typically signals a neutral-to-bullish sentiment among traders when exceeding 10%.

In summary, while Bitcoin's funding rate and basis rate indicate potential bullish trends, market sentiment remains nuanced. Traders closely monitor these indicators alongside price action and liquidation data to navigate the evolving landscape of cryptocurrency trading.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah