Bitcoin's staring down its most important price level in months. At $117,000, there's a supply wall so thick it could make or break the entire rally.

Why $117K Matters More Than You Think

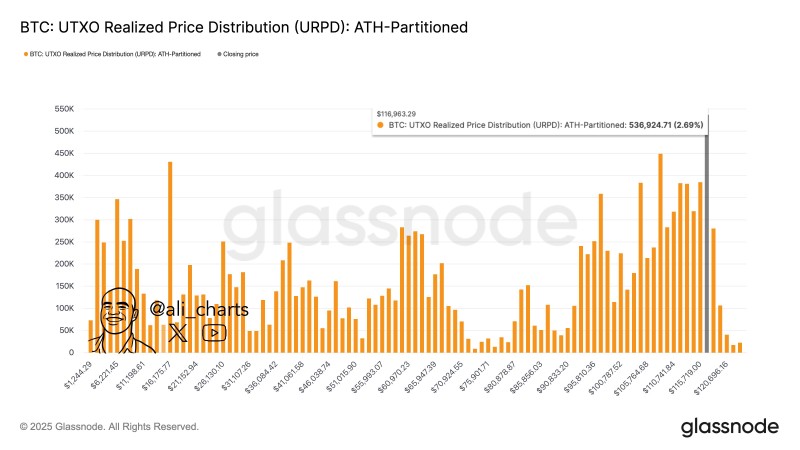

On-chain data from Ali shows this isn't just resistance - it's where a huge chunk of Bitcoin last changed hands, creating both a psychological ceiling and a structural barrier that bulls need to smash through.

The UTXO Realized Price Distribution chart from Glassnode tells the whole story. This level represents one of the heaviest concentrations of realized supply in Bitcoin's entire history. Think of it as a battlefield where thousands of traders bought in, waiting to break even or take profits. But here's the kicker: once Bitcoin clears this zone, the data shows there's almost nothing above it. Resistance just evaporates. That's when things could get wild.

The setup is textbook. There's a dense cluster right at $117K creating serious selling pressure, while a thick support base stretches from $60K to $100K where long-term holders are locked in. Above $117K? It's practically empty. Fewer coins moved at those levels means less supply ready to dump if Bitcoin makes a run for it.

What Happens Next

Right now, institutional money is flowing in, ETF adoption is climbing, and whispers of Fed rate cuts are getting louder. All of it points to Bitcoin having the fuel it needs. The question is whether buyers have enough firepower to punch through $117K. If they do, technicals suggest momentum could rocket toward $130K-$140K fast. If they don't, expect Bitcoin to slide back toward $100K and regroup before trying again.

This is the moment. Everything above depends on what happens at $117,000.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah