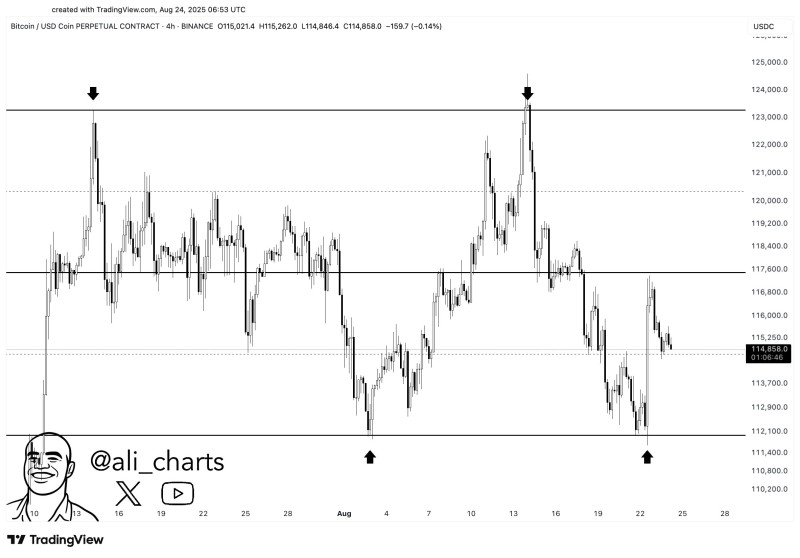

Bitcoin is sitting at a make-or-break moment. Trading just above the critical $114,600 support level at $114,858, the world's largest cryptocurrency is testing the nerves of both bulls and bears. This isn't just another sideways move—it's a pivotal point that could determine whether Bitcoin marches toward new highs or retreats to lick its wounds.

The crypto community is watching every candle, every volume spike, and every bounce off this crucial level. Why? Because what happens here could set the tone for Bitcoin's next major move, potentially unlocking a path to $120,000 or sending it back to the drawing board.

Bitcoin Price at a Critical Juncture

Right now, Bitcoin is playing a high-stakes game of support and resistance. The $114,600 level has become more than just a number on the chart—it's turned into a psychological battlefield where traders are making their stand.

Market analyst @ali_charts has been tracking this setup closely, and the picture is clear: Bitcoin has been bouncing around this range for weeks, testing the patience of everyone involved. Each test of this support makes it either stronger or more likely to crack under pressure.

$117,600 and $120,000 Targets in Focus

Here's where things get interesting. If Bitcoin can hold its ground at $114,600, the next stop on the bullish express is $117,600. This level has been playing hard to get, acting as resistance during recent attempts to break higher.

But the real prize? That's $120,000. It's not just a round number that looks good in headlines—it's a massive psychological barrier that could unlock serious FOMO if Bitcoin manages to crack it. Think of it as the gateway to potentially even bigger moves.

Of course, there's always a flip side. If $114,600 gives way, Bitcoin could find itself sliding toward the $112,000-$112,500 zone faster than you can say "buy the dip."

Usman Salis

Usman Salis

Usman Salis

Usman Salis