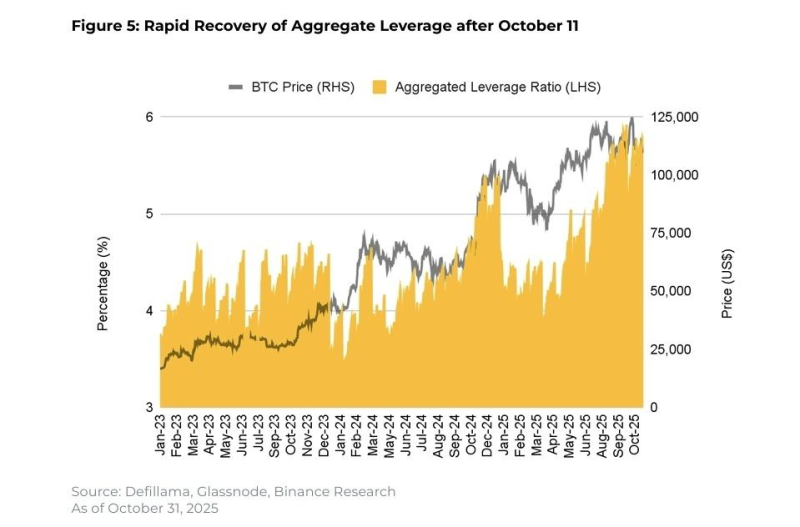

● Cas Abbé recently pointed out that October brought Bitcoin's first monthly loss since 2018, briefly rattling investor sentiment. But according to Binance Research, things weren't as bad as they seemed. Despite the early dip, leverage bounced back hard by late October, as the latest Binance Research chart shows. The data reveals a quick recovery in leverage ratios after the October 11 drop, with BTC climbing back toward the $110,000–$120,000 range—proof that confidence returned fast.

● These would hit crypto businesses with heavier fiscal demands, raising fears of bankruptcies among smaller players and a talent exodus to more crypto-friendly countries. This pressure comes at a tricky moment, just as leverage is recovering and market stability matters most.

● Regulators warn of revenue shortfalls, pushing for stricter taxes on mining, trading, and staking. Industry voices counter with a simpler fix: raise profit taxes instead of piling on new operational levies. They say this keeps the sector competitive while still funding government needs.

● In the broader context, lawmakers are weighing amendments that would change how companies calculate profit tax, how individuals report income tax, and how crypto revenues fit compliance rules. Analysts warn that rushed implementation could hurt employment and shrink long-term tax revenue. Still, despite October's swings, momentum held: BNB stayed positive, builders kept building, and fresh narratives caught fire. The x402 ecosystem hit over 720,000 daily transactions, while privacy coins surged 200–300%, showing real strength in market niches.

Usman Salis

Usman Salis

Usman Salis

Usman Salis